Log in or register to download unlimited Forex robots!

FXStreet (Guatemala) - USD/JPY is trading at 114.33, down -0.25% on the day, having posted a daily high at 114.58 and low at 114.24.

USD/JPY came off following the initial rally upon the US jobs data and starts the week on the back foot with lost ground. The seven year high was made at the end of last week and the price penetrates key resistance through 115 there. This is significant and comes with large upside potential should the bulls manage to take control back.

Fundamentals are backing the pair on the bid side and technically, Karen Jones, chief analyst at Commerzbank, also explained while above 113.15/00 the market will remain immediately bid. However, she added that below 113.00 would initiate a deeper retracement to 112.00 possibly 110.67. “It will not encounter the accelerated uptrend until 109.91. Above 115.52, we have a cloud on the quarterly chart and Fibonacci extension to 116.07/10, then there is very little until the 120 level”.

USD/JPY noteworthy levels

With spot trading at 114.34, we can see next resistance ahead at 114.38 (Hourly 100 SMA), 114.58 (Daily High), 114.82 (Daily Classic PP) and 114.88 (Hourly 20 EMA). Support below can be found at 114.26 (Weekly Classic PP), 114.05 (Daily Classic S1) and 113.67.

Heads Up: China's PPI (OCT) is due at 01:30 GMT (15 mins); -2.0% y/y expected vs prior at -1.8% y/y in September

China Econ: CPI is at 1.6% y/y vs 1.6% y/y expected in October; prior at 1.6% y/y in September

China's inflation steady in October

Asia Equity Index Update: Nikkei 16808.28 (-0.42%), Hang Seng 24058.30 (+2.15%), ASX 200 5510.50 (-0.70%)

Energy Update: NYMEX WTI Crude 78.99 (+0.43%), ICE Brent Crude 83.89 (+0.60%), NYMEX Nat Gas 4.512 (+2.47%)

Hungary sets mortgage relief conversion rate for FX loans

Hungary's banks will convert foreign currency debt into forints using the central bank's exchange rate set on November 7, the economy ministry announced late-Sunday, easing fears of a further squeeze on a hard-pressed banking sector.

Analysts had warned that a much lower exchange rate would have wiped out billions of euros worth of banking capital.

The government said the decision -- designed to make expensive foreign currency mortgages easier to pay back for troubled households -- was reached together with Hungary's Banking Association.

It also followed a recent decision by Hungary's Supreme Court that borrowers should also share the risk burden.

Last week the central bank (MNB (Other OTC: MNBC - news) ) said it would offer 9 billion euros ($11.2 billion) to commercial lenders from its reserves to neutralise the market impact of the conversion.

This would preserve the stability of the financial system and lessen impact on the forint's exchange rate, the MNB said in a statement.

Around a million Hungarians were left with skyrocketing repayments on some 10 billion euros of foreign-currency mortgages taken out before the onset of the financial crisis in 2008 as the national currency slumped.

Those loans were originally cheaper than forint-denominated debt, but as the currency has weakened it has made repaying them more expensive.

Prime Minister Viktor Orban, re-elected in April on a populist platform, has repeatedly tried to shift the loan burden onto the banking sector, which he accuses of enticing consumers with overly attractive loans.

As well as the forex loan conversion, under another new law, lenders will have to refund past fee and interest rate hikes on the loans.

Australian PM Abbott: Australian dollar at more comfortable level

Australian PM Abbott speaking in Beijing:

When the AUD was at US$1.05 it “did impose certain strains on our economy”

“The levels that we’ve seen it at in recent months are probably more comfortable for more people”

“But nevertheless it is a market-driven currency. Let’s see where the market takes it.”

UPDATE 1-China, South Korea 'effectively' conclude free trade deal

The 20-day correlation between the US Dollar & the CVIX G10 FX volatility index is 0.71, hinting $USD may rise on risk aversion

Euro Eyes ECB Bond-Buying Results, US Dollar Drops to Start the Week

Talking Points:

US Dollar Drops to Start the Week as Asia Reacts to Disappointing Payrolls

Euro Looks to ECB Covered Bond Purchase Results for Direction Guidance

BOE Governor Carney May Stoke Japanese Yen and British Pound Volatility

The US Dollar underperformed to start the week, tracking Treasury bond yields as Asian markets took their turn to react to last week’s disappointing Employment figures. The report showed a 214,000 payrolls increase in October, disappointing expectations calling for a 235,000 gain and hinting the Federal Reserve may move slower to issue its first post-QE3 interest rate hike.

Looking ahead, the European Central Bank is in spotlight as it reports the size of last week’s covered bond purchases. The first week of the program saw a mere €1.7 billion in uptake, which the markets seemed to judge as far too small to meaningfully counter deflationary pressure in the currency. With that in mind, a similar outcome this time around would suggest the ECB may be aiming to make a habit of this tepid pace, which might boost the Euro. Alternatively, a noticeably larger effort stands to weigh on the single currency.

Also of note, Bank of England Governor Mark Carney is due to speak at a press briefing in Basel ahead of the Brisbane G20 summit. Commentary touching on global growth trends at large may carry implications for risk appetite and sentiment-sensitive currencies including the Japanese Yen (with dour rhetoric set to boost the safe-haven unit, and vice versa). Signs of increased worry about spillover effects from a hobbled Eurozone economy may likewise punish the British Pound amid ebbing BOE rate hike bets.

Why don't many people post their daily winning results?

MT4talk PRO members can Turn off MT4talk daily winning result post requirements for $49.99 / month. More info...

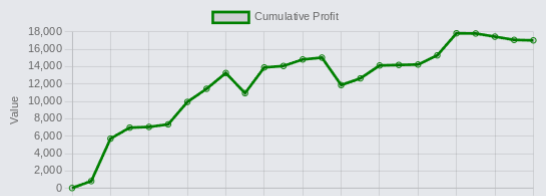

Latest profit posts from the Trade Executor EA users.

By using the MT4talk website, you automatically agree to the Forum Rules & Terms of Use, as well as the terms below.

Everything you see on the MT4talk website is created by its users, mainly the members of the MT4talk forum, as well as the forum administrators.

What is MT4talk?

MT4talk is an online Forex forum with over 5000 Forex robots and over 3000 Forex indicators uploaded by forum members in the last 10 years, available to download from forum posts. The uploaded files do not come with support or any guarantee.

The website does not sell Forex robots and does not provide support for any downloaded Forex robots. MT4talk offers a PRO membership, allowing you to download unlimited files from forum posts. If you choose to download a Forex robot from the forum, you do so at your own risk.

The MT4talk Team also provides an Artificial Intelligence Forex robot called "Trade Executor EA," which can be downloaded by PRO members, just like any other Forex robot on the forum. This Forex robot is only a bonus and is not included in the original PRO membership.

MT4talk is an informational website and does not guarantee the performance, profitability, or reliability of any Forex robot available for download. Updates for Forex robots may be limited or nonexistent, depending on the creator. If you choose to download any Forex robot or setting file from the forum, you acknowledge that you are using it at your own risk. MT4talk PRO membership is a digital product. Therefore, after you complete the PRO membership purchase, there is no refund available!

We are conducting real-life tests on Forex robots to assess their performance. For certain robots, we may use a demo account to conduct tests, and for other Forex robots, we may use a real Forex account. It's essential to recognize that we are not financial advisors and cannot provide investment guidance. Our objective is to discover effective market analysis solutions through testing various strategies, which could be beneficial to our community.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members or the MT4talk EA Tester Team about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

Affiliates Disclaimer - The website may have links to partner websites, and if you sign up and trade through these links, we will receive a commission. Our affiliate partners are FXOpen, FBS, Plexytrade, and MyForexVPS.

Copyright MT4talk.com Forum Rules - Privacy Policy.