Log in or register to download unlimited Forex robots!

GBP/NZD Forex Trade Review & GBP/USD Short Idea

Short GBP/NZD Closed

As I mentioned in my forex update last week, “it was a “perfect” textbook technical short setup, but the surprise Bank of Canada rate cut changed the game on this trade by pushing all of the comdolls lower against the majors.” Well, the pair did manage to go all the way to my stop level at 2.0160, taking me out of the trade ahead of the weekend.

Total: -499 pips/ -1.0% loss

In hindsight, I really didn’t expect the BOC to do a rate cut, but I guess I should have thought of it as a possibility with other central banks easing and inflation falling. If I had, I probably would have waited until after the event before entering at market. And even if I had waited, I still would have shorted as I feel the pair is still in a technical downtrend and yet to be invalidated even today. We even have a bearish divergence setup forming on the chart above.

But with the Reserve Bank of New Zealand issuing their own monetary policy decision at the end of the Wednesday U.S. trading session, I’ll hold off on jumping back in short on GBP/NZD for now. Who knows what the RBNZ has cooked up, which could be as surprising and market moving as both the ECB and BOC.

Overall, I wouldn’t hesitate taking this textbook technical trade setup again in the future–it was just a bit of bad luck with the Bank of Canada surprise rate cut. And that’s why I always trade with stops, for when the story unexpectedly changes.

Short GBP/USD Once Again

I didn’t get a chance to catch the downtrend with my last attempt to short GBP/USD, but with Cable bouncing off of the 1.5000 major psychological area, I may get a chance to play my long USD bias once again at a better than market price.

My fundamental argument remains the same as my last GBP/USD trade idea, but there is an “X factor” this week with the upcoming FOMC monetary policy meeting. With the Greenback going on a monster rally since mid-2014 and now that we’re past the end of QE, I think any dovish speak from the Fed could bring in more USD sellers on gain taking. Dovish rhetoric may not be out of the question with the global inflation still falling and the global economy’s growth concerns still an issue, and the strong U.S. dollar may be a hinderance to the U.S. export economy down the road. Let’s not forget what Greece will do next now that an anti-austerity party is in power. So many uncertainties.

With so many uncertainties and the pair testing a major psychological area around 1.5000, I’m going with a conservative short entry near the top of the recent consolidation area highlighted in the chart above, and doing it with a small position with the intent to add if the trade does go my way. My stop will be my usual weekly ATR calculation and my max target will be the next major support level, last seen in May 2010. Here’s what I am doing:

Short half position GBP/USD at 1.5200, stop 1.5400, max target at 1.4300

Remember to never risk more than 1% of a trading account on any single trade. Adjust position sizes accordingly. Create your own ideas and don’t follow what I do. Risk Disclosure.

HI Tuiwin,

In above sharing, are this manual trade or you have make this into EA for auto trade?

any indicator to be share?

Thanks.

Why don't many people post their daily winning results?

MT4talk PRO members can Turn off MT4talk daily winning result post requirements for $49.99 / month. More info...

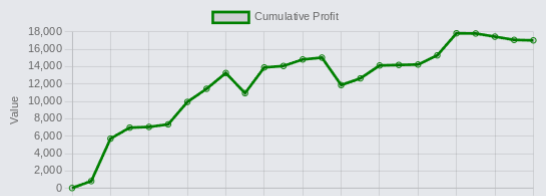

Latest profit posts from the Trade Executor EA users.

By using the MT4talk website, you automatically agree to the Forum Rules & Terms of Use, as well as the terms below.

Everything you see on the MT4talk website is created by its users, mainly the members of the MT4talk forum, as well as the forum administrators.

What is MT4talk?

MT4talk is an online Forex forum with over 5000 Forex robots and over 3000 Forex indicators uploaded by forum members in the last 10 years, available to download from forum posts. The uploaded files do not come with support or any guarantee.

The website does not sell Forex robots and does not provide support for any downloaded Forex robots. MT4talk offers a PRO membership, allowing you to download unlimited files from forum posts. If you choose to download a Forex robot from the forum, you do so at your own risk.

The MT4talk Team also provides an Artificial Intelligence Forex robot called "Trade Executor EA," which can be downloaded by PRO members, just like any other Forex robot on the forum. This Forex robot is only a bonus and is not included in the original PRO membership.

MT4talk is an informational website and does not guarantee the performance, profitability, or reliability of any Forex robot available for download. Updates for Forex robots may be limited or nonexistent, depending on the creator. If you choose to download any Forex robot or setting file from the forum, you acknowledge that you are using it at your own risk. MT4talk PRO membership is a digital product. Therefore, after you complete the PRO membership purchase, there is no refund available!

We are conducting real-life tests on Forex robots to assess their performance. For certain robots, we may use a demo account to conduct tests, and for other Forex robots, we may use a real Forex account. It's essential to recognize that we are not financial advisors and cannot provide investment guidance. Our objective is to discover effective market analysis solutions through testing various strategies, which could be beneficial to our community.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members or the MT4talk EA Tester Team about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

Affiliates Disclaimer - The website may have links to partner websites, and if you sign up and trade through these links, we will receive a commission. Our affiliate partners are FXOpen, FBS, Plexytrade, and MyForexVPS.

Copyright MT4talk.com Forum Rules - Privacy Policy.