Log in or register to download unlimited Forex robots!

Japanese shares hit 7-year highs on tax-relief hopes

* Japan shares up on prospect of delay in sales tax hike

* Japanese bond yields rise to 1-month high

* Asian shares flat after holiday-thinned U.S. session

By Hideyuki Sano

TOKYO, Nov 12 (Reuters) - Japanese stocks scaled seven-year highs on Wednesday on growing expectations Prime Minister Shinzo will postpone a planned sales tax hike to avoid damaging a fragile recovery, and call a snap election to bolster his political standing.

Equity markets in the rest of Asia moved little after a flat close in a holiday-thinned Wall Street session, with MSCI's broadest index of Asia-Pacific shares outside Japan off just 0.1 percent in early trade.

Japan's Nikkei rose 0.8 percent to hit a fresh seven-year high.

The Sankei newspaper, citing unnamed government and coalition officials, said Abe will delay a planned second sales tax increase by a year and a half and take the issue to voters. Abe on Tuesday said he had yet to decide on the timing of an election.

Abe has said he will make up his mind on the tax increase after assessing the July-September GDP data due next Monday, widely expected to highlight the fragility of the rebound following a sharp contraction in the second quarter.

The first increase in the two-stage sale tax hike in April knocked the Japanese economy hard, and markets view a delay in the second-phase of the tax hike as positive for growth.

A snap election could cement Abe's grip on power because opposition parties are too fragmented to win, despite a decline in the prime minister's approval ratings.

"Short-term players are jumping onto this, although in the long run, this just means a delay in fiscal reform and not necessarily positive," said Ayako Sera, senior market economist at Sumitomo Mitsui Trust Bank.

Indeed, Japanese government bond prices fell as a delay in the planned tax hike would heighten doubts on whether Tokyo can achieve its fiscal target to balance the budget outside debt payments by 2020.

The 10-year Japanese Government Bond yield rose to one-month high of 0.515 percent, up 3.5 basis points from Tuesday close.

However, given massive bond-buying by the Bank of Japan, investors see limited room for further rises in JGB yields.

The yen, which has remained under pressure for nearly two years due to the BOJ's aggressive stimulus, was on the back foot.

The greenback traded at 115.80 yen, having risen to a seven-year high of 116.11 yen on Tuesday.

The dollar lost a bit of steam against other currencies, as investors took profits from its hefty gains in the last few months.

The euro traded at $1.2477, keeping some distance from a two-year low of $1.2358 hit on Friday.

In the energy market, Brent crude futures in London closed down 67 cents on Tuesday, or 0.8 percent, at $81.67 a barrel after hitting a four-year low of $81.23. U.S. crude fell 0.7 percent in Asia on Wednesday.

Some analysts said Brent fared worse on Tuesday because of growing expectations that global producer group OPEC will not cut output. (Editing by Shri Navaratnam)

Thanks for the good news if i get this kind of news everyday that will be very good for me.

thanks.

Why don't many people post their daily winning results?

MT4talk PRO members can Turn off MT4talk daily winning result post requirements for $49.99 / month. More info...

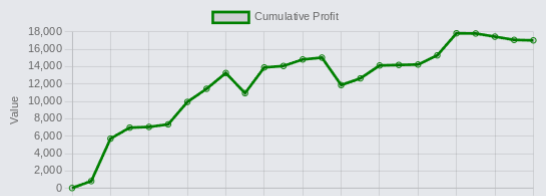

Latest profit posts from the Trade Executor EA users.

By using the MT4talk website, you automatically agree to the Forum Rules & Terms of Use, as well as the terms below.

Everything you see on the MT4talk website is created by its users, mainly the members of the MT4talk forum, as well as the forum administrators.

What is MT4talk?

MT4talk is an online Forex forum with over 5000 Forex robots and over 3000 Forex indicators uploaded by forum members in the last 10 years, available to download from forum posts. The uploaded files do not come with support or any guarantee.

The website does not sell Forex robots and does not provide support for any downloaded Forex robots. MT4talk offers a PRO membership, allowing you to download unlimited files from forum posts. If you choose to download a Forex robot from the forum, you do so at your own risk.

The MT4talk Team also provides an Artificial Intelligence Forex robot called "Trade Executor EA," which can be downloaded by PRO members, just like any other Forex robot on the forum. This Forex robot is only a bonus and is not included in the original PRO membership.

MT4talk is an informational website and does not guarantee the performance, profitability, or reliability of any Forex robot available for download. Updates for Forex robots may be limited or nonexistent, depending on the creator. If you choose to download any Forex robot or setting file from the forum, you acknowledge that you are using it at your own risk. MT4talk PRO membership is a digital product. Therefore, after you complete the PRO membership purchase, there is no refund available!

We are conducting real-life tests on Forex robots to assess their performance. For certain robots, we may use a demo account to conduct tests, and for other Forex robots, we may use a real Forex account. It's essential to recognize that we are not financial advisors and cannot provide investment guidance. Our objective is to discover effective market analysis solutions through testing various strategies, which could be beneficial to our community.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members or the MT4talk EA Tester Team about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

Affiliates Disclaimer - The website may have links to partner websites, and if you sign up and trade through these links, we will receive a commission. Our affiliate partners are FXOpen, FBS, Plexytrade, and MyForexVPS.

Copyright MT4talk.com Forum Rules - Privacy Policy.