Log in or register to download unlimited Forex robots!

US Dollar Follows Treasury Yields Lower as Japan Slips into Recession

Talking Points:

US Dollar Falls as Treasury Bond Yields Sink After Japan Enters Recession

Yen Spikes Down as Tax Hike Chances Fade, Rebounds on Political Turmoil

Euro Looking to ECB Bond Purchase Tally, Draghi Testimony for Direction

The US Dollar underperformed in overnight trade, sliding as much as 0.4 percent on average against its leading counterparts. The decline tracked a slide in benchmark 10-year Treasury bond yields, pointing to eroding rates appeal as the catalyst behind the selloff. For their part, yields moved lower as an unexpectedly soft Japanese GDP figure triggered risk aversion, fueling haven-linked demand for Treasuries and pushing bond prices upward.

The preliminary third-quarter data set showed Japan slipped into a technical recession, with output shrinking 0.4 percent compared with the three months through June. Economists were penciling in a 0.5 percent expansion ahead of the announcement. The second-quarter reading was also revised lower to reveal a 1.9 percent contract, a slightly larger drop than the 1.8 percent dip initially reported. The New Zealand Dollar led the way higher against the greenback as a robust Retail Sales report amplified Japan-linked price action. Receipts rose 1.5 percent in the third quarter, topping forecasts for a 0.8 percent advance and registering the largest gain in over two years.

As for the Japanese Yen, the currency initially spiked lower after the GDP report, presumably reflecting the ebbing probability of another sales tax increase (planned to go up to 10 percent in October 2015). That reaction was swiftly overturned however as risk aversion gripped the markets and pushed the safety-geared unit higher. The dour reaction may have reflected rising political uncertainty amid rumors that Prime Minister Shinzo Abe will dissolve the lower house of the Diet and call a snap election as soon as tomorrow, presumably to reclaim a mandate as the economy sputters.

Looking ahead, the outlook for European Central Bank monetary policy dominates the spotlight. The central bank will report the size of last week’s covered bond purchases while ECB President Mario Draghiwill deliver his quarterly testimony to the European Parliament. Traders will look to the former to see if officials are stepping up the pace of balance sheet expansion, an effort heretofore judged as insufficient to jump-start lending and reverse the slide toward deflation. Meanwhile, Draghi’s comments will be closely scrutinized for clues as to the ECB’s willingness to introduce “sovereign QE” should the medley of easing measures introduced this year fall short. A pickup in bond uptake and/or a strongly-worded commitment to overturn sinking inflation by whatever means are necessary may weigh on the Euro.

Why don't many people post their daily winning results?

MT4talk PRO members can Turn off MT4talk daily winning result post requirements for $49.99 / month. More info...

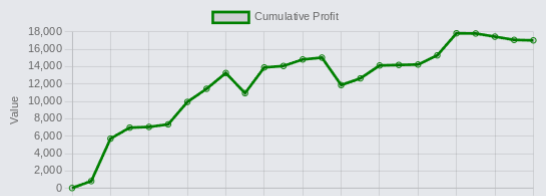

Latest profit posts from the Trade Executor EA users.

By using the MT4talk website, you automatically agree to the Forum Rules & Terms of Use, as well as the terms below.

Everything you see on the MT4talk website is created by its users, mainly the members of the MT4talk forum, as well as the forum administrators.

What is MT4talk?

MT4talk is an online Forex forum with over 5000 Forex robots and over 3000 Forex indicators uploaded by forum members in the last 10 years, available to download from forum posts. The uploaded files do not come with support or any guarantee.

The website does not sell Forex robots and does not provide support for any downloaded Forex robots. MT4talk offers a PRO membership, allowing you to download unlimited files from forum posts. If you choose to download a Forex robot from the forum, you do so at your own risk.

The MT4talk Team also provides an Artificial Intelligence Forex robot called "Trade Executor EA," which can be downloaded by PRO members, just like any other Forex robot on the forum. This Forex robot is only a bonus and is not included in the original PRO membership.

MT4talk is an informational website and does not guarantee the performance, profitability, or reliability of any Forex robot available for download. Updates for Forex robots may be limited or nonexistent, depending on the creator. If you choose to download any Forex robot or setting file from the forum, you acknowledge that you are using it at your own risk. MT4talk PRO membership is a digital product. Therefore, after you complete the PRO membership purchase, there is no refund available!

We are conducting real-life tests on Forex robots to assess their performance. For certain robots, we may use a demo account to conduct tests, and for other Forex robots, we may use a real Forex account. It's essential to recognize that we are not financial advisors and cannot provide investment guidance. Our objective is to discover effective market analysis solutions through testing various strategies, which could be beneficial to our community.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members or the MT4talk EA Tester Team about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

Affiliates Disclaimer - The website may have links to partner websites, and if you sign up and trade through these links, we will receive a commission. Our affiliate partners are FXOpen, FBS, Plexytrade, and MyForexVPS.

Copyright MT4talk.com Forum Rules - Privacy Policy.