Log in or register to download unlimited Forex robots!

What are the lessons derived from this example?

First, the correspondence between technical values and actual prices is weak. And as we stated in the beginning, it’s not possible to base our trade timing on a price and an indicator at the same time. Second, technical indicators have a tendency to surprise, and how much a trader relies on them will depend on both his risk tolerance and trading preferences. Lastly, technical divergences, while useful as indicators, can also be dangerous when they occur at the time when we are willing to realize a profit.So what is the use of technical analysis in timing our trades? Most importantly, how are we going to ensure that we don’t suffer great losses when divergences on the indicators appear and invalidate our strategy, and blur our power of foresight?The potential of the divergence/convergence phenomenon for creating entry points has been examined extensively by the trader community, but its tendency to complicate the exit point has not received much attention. But it is just one of the many aspects of trade timing that is complicated by the unexpected inconsistencies which appear between price and everything else. So if we had the choice, we would prefer to exclude price from all the calculations made in order to reduce the degree of uncertainty and chaos from our trades. Unfortunately that is not possible, as price is the only determinant of profit and loss in our trades.In trade timing, the trader has to take some risk. The best way of taking the risk and avoiding excessive losses is using a layered defense line, so to speak, against market fluctuations and adverse movements and we discussed how to do this in our article on stop loss orders. The best way of taking the risk and maximizing our profits is the subject of entry timing, and the best way of doing so is using an attack line that is also layered. What do we mean by that?In ancient warfare, it was well-understood that the commander must keep some of his forces fresh and uncommitted to exploit the opportunities and crises that arise during the course of a battle. For instance, if the commander had run out of cavalry reserves when the enemy launched a major charge against one of his flanks, he might have found himself in an extremely unpleasant situation. Similarly, if he had no rested and ready troops to mount a charge at the time his opponent demonstrated signs of exhaustion, a major opportunity would have been lost.The layered attack technique of the trader aims to utilize the same principle with the purpose of not running out of capital at the crucial moment. In essence we want to make sure that we commit our assets (that is our capital) in a layered, ****ual manner for the dual purpose of eliminating the problems caused by faulty timing, and also outlasting the periods associated with greatest volatility. By opening a position with only a small portion of our capital, we ensure that the initial risk taken is small. By adding to it ****ually, we make sure that our rising profits are riding a trend that has the potential to last long. Finally, by committing our capital when the trend shows signs of weakness, we build up our own confidence, while controlling our risk properly by placing our stop-loss orders on a price level that may bring profits instead of losses.To sum it up, the golden rule of trade timing is to keep it small, and to avoid timing by entering a position ****ually. Since it is not possible to know anything about the markets with certainty, we will seek to have our scenario confirmed by market action through ****ual, small positions that are built up in time. This scheme will eliminate the complicated issues associated with trade timing, while allowing us great comfort while entering and exiting trades.

Why don't many people post their daily winning results?

MT4talk PRO members can Turn off MT4talk daily winning result post requirements for $49.99 / month. More info...

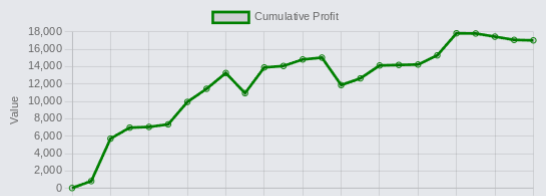

Latest profit posts from the Trade Executor EA users.

By using the MT4talk website, you automatically agree to the Forum Rules & Terms of Use, as well as the terms below.

Everything you see on the MT4talk website is created by its users, mainly the members of the MT4talk forum, as well as the forum administrators.

What is MT4talk?

MT4talk is an online Forex forum with over 5000 Forex robots and over 3000 Forex indicators uploaded by forum members in the last 10 years, available to download from forum posts. The uploaded files do not come with support or any guarantee.

The website does not sell Forex robots and does not provide support for any downloaded Forex robots. MT4talk offers a PRO membership, allowing you to download unlimited files from forum posts. If you choose to download a Forex robot from the forum, you do so at your own risk.

The MT4talk Team also provides an Artificial Intelligence Forex robot called "Trade Executor EA," which can be downloaded by PRO members, just like any other Forex robot on the forum. This Forex robot is only a bonus and is not included in the original PRO membership.

MT4talk is an informational website and does not guarantee the performance, profitability, or reliability of any Forex robot available for download. Updates for Forex robots may be limited or nonexistent, depending on the creator. If you choose to download any Forex robot or setting file from the forum, you acknowledge that you are using it at your own risk. MT4talk PRO membership is a digital product. Therefore, after you complete the PRO membership purchase, there is no refund available!

We are conducting real-life tests on Forex robots to assess their performance. For certain robots, we may use a demo account to conduct tests, and for other Forex robots, we may use a real Forex account. It's essential to recognize that we are not financial advisors and cannot provide investment guidance. Our objective is to discover effective market analysis solutions through testing various strategies, which could be beneficial to our community.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members or the MT4talk EA Tester Team about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

Affiliates Disclaimer - The website may have links to partner websites, and if you sign up and trade through these links, we will receive a commission. Our affiliate partners are FXOpen, FBS, Plexytrade, and MyForexVPS.

Copyright MT4talk.com Forum Rules - Privacy Policy.