Log in or register to download unlimited Forex robots!

Bank of England minutes: Economic slowdown and exchange rate effects m

Review of the Bank of England’s MPC monetary policy meeting minutes 19 November 2014

In the minutes they’ve twice mentioned the mid-October wobble in markets for adding to uncertainty over the economy.

Sterling and US dollar implied interest rate volatilities had increased sharply in the middle of

October. The MOVE index of dollar interest rate implied volatility briefly reached its highest levels

since September 2013, a time of heightened uncertainty and speculation over the prospects for US

monetary policy. Although this most recent spike had followed a sequence of weak data releases,

market intelligence suggested that price movements had been exacerbated by some investors closing out a variety of active trading positions that had become increasingly unprofitable over recent months as perceptions of the global economic outlook had softened.

Business survey data released during the month had, in general, added to the sense that economic activity might have marginally less momentum going into the new year than had been assumed in August. It was possible that survey responses had been disproportionately affected by the temporary increase in financial market uncertainty in the middle of the month. More broadly, while a little softer, indicators of output remained at levels consistent with relatively solid growth.

The finger has also been pointed at Europe, as we know

Earlier in the year, the Committee had envisaged that the anticipated easing in growth would be

centred in private domestic demand. Given the slowdown in global economic growth, especially in the

euro area, it had not been surprising to see signs that the recent slowing of output had also been 5

associated with weakening export demand.

A shift in inflation sentiment could become a self-fulfilling prophecy, particularly in wages

With a period of inflation below target in prospect, it was conceivable that firms’, households’

and financial market participants’ expectations of future inflation might begin to drift downwards in a way that could reinforce the weakness of inflation itself – for instance, via wage bargaining

Generally the minutes echo the inflation report with regards to CPI

A word of warning also over the country’s finances

With the fiscal consolidation set to continue and export prospects subdued, even lower private

sector saving would probably be necessary to sustain UK output growth at the historical average rates

envisaged in the November Inflation Report central projection. The prospect of a continued reduction

in private sector saving and a persistent current account deficit should be carefully monitored.

The household saving rate was already at a relatively low level and was projected to fall further over

the forecast period. Continued falls would raise the economy’s dependence on external finance and could not be sustained indefinitely.

There is still also uncertainty over how much slack there is and it’s effect on both inflation and wage growth and whether the effect of the strong pound had a material effect on CPI.

One explanation for some of the recent weakness of inflation could be that the pass-through to

lower consumer prices of the appreciation of sterling since the start of 2013 had been faster or stronger

than anticipated. While sterling’s appreciation was no doubt playing a part in holding inflation

below the target – and would probably continue to do so – there was not yet evidence to suggest that

the effect would be any different than had been supposed at the time the Committee had assessed the

outlook in its August Inflation Report. (here’s what the inflation report said “In the light of

sterling’s recent appreciation, import prices, which have been pushing up inflation in recent years, are now falling.”)

So overall we know that we’ve seen a slowdown but the BOE are not keeping an overly dovish look on the economy. The main factor in keeping our economy subdued is exports but domestically we’re still ok. A shift in sentiment on lower inflation could manifest itself into actions taken by businesses but probably the lower costs that will be felt in people’s pockets should counter that somewhat, even if it’s only a temporary event.

As I said in the vote post the minutes aren’t as dovish as the market may have been expecting and that’s probably going to be enough to see the pound steady itself into the end of the year.

Lots more can happen but there’s still no hint from the BOE that rates are not going up, and that’s all the market wants to know.

It looks like the market is coming to the same conclusion after chewing over the details as cable is now pushing 1.5670

Why don't many people post their daily winning results?

MT4talk PRO members can Turn off MT4talk daily winning result post requirements for $49.99 / month. More info...

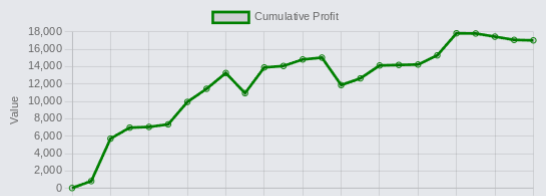

Latest profit posts from the Trade Executor EA users.

By using the MT4talk website, you automatically agree to the Forum Rules & Terms of Use, as well as the terms below.

Everything you see on the MT4talk website is created by its users, mainly the members of the MT4talk forum, as well as the forum administrators.

What is MT4talk?

MT4talk is an online Forex forum with over 5000 Forex robots and over 3000 Forex indicators uploaded by forum members in the last 10 years, available to download from forum posts. The uploaded files do not come with support or any guarantee.

The website does not sell Forex robots and does not provide support for any downloaded Forex robots. MT4talk offers a PRO membership, allowing you to download unlimited files from forum posts. If you choose to download a Forex robot from the forum, you do so at your own risk.

The MT4talk Team also provides an Artificial Intelligence Forex robot called "Trade Executor EA," which can be downloaded by PRO members, just like any other Forex robot on the forum. This Forex robot is only a bonus and is not included in the original PRO membership.

MT4talk is an informational website and does not guarantee the performance, profitability, or reliability of any Forex robot available for download. Updates for Forex robots may be limited or nonexistent, depending on the creator. If you choose to download any Forex robot or setting file from the forum, you acknowledge that you are using it at your own risk. MT4talk PRO membership is a digital product. Therefore, after you complete the PRO membership purchase, there is no refund available!

We are conducting real-life tests on Forex robots to assess their performance. For certain robots, we may use a demo account to conduct tests, and for other Forex robots, we may use a real Forex account. It's essential to recognize that we are not financial advisors and cannot provide investment guidance. Our objective is to discover effective market analysis solutions through testing various strategies, which could be beneficial to our community.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members or the MT4talk EA Tester Team about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

Affiliates Disclaimer - The website may have links to partner websites, and if you sign up and trade through these links, we will receive a commission. Our affiliate partners are FXOpen, FBS, Plexytrade, and MyForexVPS.

Copyright MT4talk.com Forum Rules - Privacy Policy.