Log in or register to download unlimited Forex robots!

on Retail Forex, Regulators Have Failed To Reach Far Enough

The record fines recently handed down to global banks for alleged manipulation of foreign exchange rates and front running of customer trades may seem like par after similar allegations for LIBOR and other benchmark rates. One might conclude it’s just another story about Wall Street excess and regulatory failures observed during the financial crisis. However, since these allegations are coming after regulators implemented the key provisions of Dodd-Frank, they probably won’t be the last shoes to drop.

For those fighting in the trenches, enforcement actions in forex markets are not news. As then-Chair of the Commodity Futures Trading Commission (CFTC), I testified before Congress in 2004 that retail forex had become the “fraud du jour” at that time, owing to the expansion of the internet and the decline in the dollar. We brought nearly 100 enforcement cases and levied over $1 billion in fines for alleged forex fraud, but lost a key court decision in CFTC v. Zelener. That decision rejected CFTC regulatory authority that had been granted by Congress in 2000 and put CFTC efforts to assert jurisdiction in the forex markets in limbo. While legislation in 2008 and the Dodd-Frank Act in 2010 reaffirmed CFTC jurisdiction in the retail forex market, regulatory efforts have focused on post hoc forex enforcement actions, and have not addressed the need for market standards to ensure transparency and curb questionable dealing practices at play in the retail forex market.

The central problems in retail forex stem from conflicts of interest between forex dealers and customers under the traditional “dealing desk” trade execution model. In the dealing desk model, the “house” acts as its customers’ sole counterparty and internalizes most of its clients’ trades, meaning that the customer’s loss is the house’s gain, and vice versa. This inherent conflict of interest results in a zero-sum competition between the house and the customer, incentivizing self-dealing and questionable dealing practices, such as customer profiling, excessive requoting, quoting off-market, and stop hunting.

Obstacles to price comparisons and price discovery for customers

Such dealing practices are exacerbated by the information monopoly inherent when the house acts as the sole price provider for its retail clients, and generally reserves the right to quote prices that are not derived from overall market supply and demand or referenced to any benchmark. Some dealer platforms engage in customer profiling – quoting different prices to different customers – to target less sophisticated customers. These market structures, combined with the lesser sophistication and experience of retail forex customers, create obstacles to price comparisons and price discovery for customers.

Retail forex has grown markedly since the early days of the internet when bucket shops proliferated and enforcement was the only recourse. Increases in capital requirements and limits in leverage have helped build a stronger industry where fraud and sales practice violations have decreased markedly. Electronic communication network and straight-through processing trade execution models used by some platforms level the playing field for investors and can eliminate the inherent conflict of interest – but these practices are not regulated in forex as they are in other markets.

As an economist, I am not known for a penchant for micromanaging markets, but the retail forex market has been an Achilles heel for too long—it is ripe for regulatory actions that adopt trading rules at least as strict as those imposed on every other asset class. The conflicts of interest inherent to many retail forex dealer platforms’ practices would draw immediate scrutiny in equity markets under National Market System regulations or in derivatives markets under Dodd-Frank regulations—indeed, the retail forex market’s trade execution opacity runs counter to rules and norms in all other major financial markets.

http://www.forbes.com/sites/realspin/20 … ar-enough/

Why don't many people post their daily winning results?

MT4talk PRO members can Turn off MT4talk daily winning result post requirements for $49.99 / month. More info...

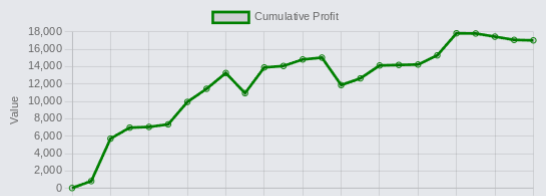

Latest profit posts from the Trade Executor EA users.

By using the MT4talk website, you automatically agree to the Forum Rules & Terms of Use, as well as the terms below.

Everything you see on the MT4talk website is created by its users, mainly the members of the MT4talk forum, as well as the forum administrators.

What is MT4talk?

MT4talk is an online Forex forum with over 5000 Forex robots and over 3000 Forex indicators uploaded by forum members in the last 10 years, available to download from forum posts. The uploaded files do not come with support or any guarantee.

The website does not sell Forex robots and does not provide support for any downloaded Forex robots. MT4talk offers a PRO membership, allowing you to download unlimited files from forum posts. If you choose to download a Forex robot from the forum, you do so at your own risk.

The MT4talk Team also provides an Artificial Intelligence Forex robot called "Trade Executor EA," which can be downloaded by PRO members, just like any other Forex robot on the forum. This Forex robot is only a bonus and is not included in the original PRO membership.

MT4talk is an informational website and does not guarantee the performance, profitability, or reliability of any Forex robot available for download. Updates for Forex robots may be limited or nonexistent, depending on the creator. If you choose to download any Forex robot or setting file from the forum, you acknowledge that you are using it at your own risk. MT4talk PRO membership is a digital product. Therefore, after you complete the PRO membership purchase, there is no refund available!

We are conducting real-life tests on Forex robots to assess their performance. For certain robots, we may use a demo account to conduct tests, and for other Forex robots, we may use a real Forex account. It's essential to recognize that we are not financial advisors and cannot provide investment guidance. Our objective is to discover effective market analysis solutions through testing various strategies, which could be beneficial to our community.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members or the MT4talk EA Tester Team about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

Affiliates Disclaimer - The website may have links to partner websites, and if you sign up and trade through these links, we will receive a commission. Our affiliate partners are FXOpen, FBS, Plexytrade, and MyForexVPS.

Copyright MT4talk.com Forum Rules - Privacy Policy.