Log in or register to download unlimited Forex robots!

Global Disinflationary Winds Blow Hard

The carnage for the hydrocarbon complex is showing no signs of abating, with both WTI and Brent hitting fresh cycle lows this morning. The supply and demand function for commodities has been touted as the main catalyst for triggering the flush in oil price action, as sticky, higher-cost supply has been unable to react to waning global demand. Not as widely acknowledged in the financial media has been the extent at which crude has become one of the most ‘financialized’ commodities, and the 50% haircut over the last year has sparked a wave of stop-loss selling from money managers capitulating on their long-crude bets. We would argue that while the continued decimation of commodities will translate into short-term pain for North American GDP as rigs closures and employment losses weigh on economic growth, stabilization in oil prices are key to supporting both investor and consumer confidence.

In addition, the supply and demand function might not be as dire as one is expecting, as China posted optimistic trade balance numbers overnight for the month of December. Exports rose by 9.7% versus estimates of a 6.8% increase, while imports fell by 2.4%, slower than the 7.4% contraction that had been forecast. The overall trade surplus came in narrower than expected due to better than forecast import volume, though the silver lining for commodity exporters was that China took advantage of the decline in crude prices and snapped up the largest monthly volume of oil on record, an increase of 13.4% from the corresponding month last year.

Whether the up-tick in demand for crude from China is an opportunistic purchase, or demand might not be slowing as much as anticipated, these numbers will be important to follow in the coming months. The data has done little to impede the wash-out in energy, with front-month WTI falling below the $45 handle, and thus putting pressure on the loonie with USDCAD making an attempt at overtaking the psychologically important 1.20 level. While we expect there to be decent barrier defense at the 1.20 handle for USDCAD, the failure for oil to stabilize itself and continue its decline will likely aid USDCAD in its push higher.

The oil rout has also sparked concern over deflationary forces on a global basis, as witnessed last week by the eurozone, and again today as inflation figures for the UK missed expectations by a wide margin and will force Governor Mark Carney to write an open letter explaining why prices have dropped below the 1.0% threshold on an annualized basis. Falling energy and food prices weighed down the headline reading to print at only 0.5% in December, down from the 1.0% increase registered in November, and the 0.7% pace economists had been expecting. The disinflationary pressures are likely to help Carney keep his dovish majority on the Monetary Policy Committee, justifying the current level of monetary stimulus until at least the end of 2015. The ongoing revisions to when the rate tightening cycle in the UK will begin has lopped off over 12% of the pound’s value against the greenback when compared to the middle of 2014, with market participants now expecting a rate tightening from the BoE not to emerge until early 2016. The pound is essentially unchanged against the big dollar in the high-1.51s as we head into the North American open, but today’s inflation reading serves to underscore the disinflationary pressures felt on a global scale, and how monetary policy will continue to diverge between the Fed and the rest of the developed world.

Why don't many people post their daily winning results?

MT4talk PRO members can Turn off MT4talk daily winning result post requirements for $49.99 / month. More info...

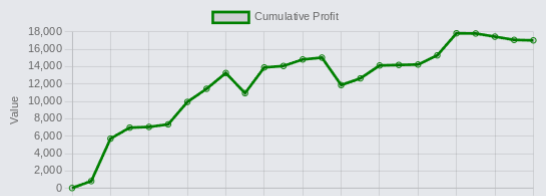

Latest profit posts from the Trade Executor EA users.

By using the MT4talk website, you automatically agree to the Forum Rules & Terms of Use, as well as the terms below.

Everything you see on the MT4talk website is created by its users, mainly the members of the MT4talk forum, as well as the forum administrators.

What is MT4talk?

MT4talk is an online Forex forum with over 5000 Forex robots and over 3000 Forex indicators uploaded by forum members in the last 10 years, available to download from forum posts. The uploaded files do not come with support or any guarantee.

The website does not sell Forex robots and does not provide support for any downloaded Forex robots. MT4talk offers a PRO membership, allowing you to download unlimited files from forum posts. If you choose to download a Forex robot from the forum, you do so at your own risk.

The MT4talk Team also provides an Artificial Intelligence Forex robot called "Trade Executor EA," which can be downloaded by PRO members, just like any other Forex robot on the forum. This Forex robot is only a bonus and is not included in the original PRO membership.

MT4talk is an informational website and does not guarantee the performance, profitability, or reliability of any Forex robot available for download. Updates for Forex robots may be limited or nonexistent, depending on the creator. If you choose to download any Forex robot or setting file from the forum, you acknowledge that you are using it at your own risk. MT4talk PRO membership is a digital product. Therefore, after you complete the PRO membership purchase, there is no refund available!

We are conducting real-life tests on Forex robots to assess their performance. For certain robots, we may use a demo account to conduct tests, and for other Forex robots, we may use a real Forex account. It's essential to recognize that we are not financial advisors and cannot provide investment guidance. Our objective is to discover effective market analysis solutions through testing various strategies, which could be beneficial to our community.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members or the MT4talk EA Tester Team about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

Affiliates Disclaimer - The website may have links to partner websites, and if you sign up and trade through these links, we will receive a commission. Our affiliate partners are FXOpen, FBS, Plexytrade, and MyForexVPS.

Copyright MT4talk.com Forum Rules - Privacy Policy.