Log in or register to download unlimited Forex robots!

Now Embrace the artificial intelligence for the buy-side

The expanding utilization of artificial intelligence and AI frameworks among purchase side firms is in threat of making a publicity bubble –

The TRADE inspects where resource administrators are at present utilizing these advances to streamline their exchanging methodologies and what traps firms must stay away from to (in the end) encourage an agreeable exchanging among man and machine.

The utilization of artificial intelligence (AI) and AI (ML) advances in money related administrations is as a rule progressively situated at the vanguard of innovation centered industry talk and systems, as dialogs center around the useful ramifications of sending such apparatuses past center and back-office capacities.

As edges are pressed and costs keep on ascending in light of charge pressure and an expanded administrative condition, the purchase side is progressively going to AI and ML in the quest for further efficiencies.

There can be no uncertainty that tremendous increments in information and exchanging volumes that the purchase side is presently executing, is constraining the requirement for new advancements.

While partaking in a board dialog at the current year's TradeTech Europe gathering, AXA Investment Managers worldwide head of exchanging, Daniel Leon, told delegates that his firm must choose the option to put resources into new advances since his exchanging work area essentially can't stay aware of the sheer measure of information and data required to maintain its exchange movement.

"We are not ready to do what we used to complete 20 years back," said Leon. "Truly, you can have an authority on influence advance, however on the enormous credit market or medium and little top, you can't have such data on one person.

We are attempting to take care of issues that we used to complete quite a while back. For the more vintage brokers it used to be that the dealer would know the market and what's exchanged for one month, what happened a week ago, they had data and that is the thing that commonplace exchanging used to be.

"Yet, presently we need to gain effectiveness, we need to exchange such a large number of bonds that you can't request that one dealer remember everything, to realize that this part a week ago had this occasion.

We need to reconstitute the experience that the dealer used to have: What has exchanged, what was the liquidity and what was the market sway. You can't do that on a thorough premise."

BlackRock's worldwide head of exchanging, Supurna VedBrat, reverberated Leon's feeling on the significance of AI and information for the fate of the business at the current year's US Fixed Income Leaders Summit in Philadelphia.

Concentrating on fixed pay markets, VedBrat told delegates that not exclusively will AI be a key component in the development of purchase side exchanging tasks, however, it will probably transform the job of the purchase side dealer simultaneously.

"Information science and AI enables us to genuinely increase human intelligence with registering force, and you can do that at scale. I think it is going to tangibly change exchanging systems that the purchase side employments.

You needn't bother with human intelligence to pick exchanges, so you can robotize a great deal of that stream and the broker is currently considerably more of a hazard chief managing that the market is working the manner in which we expect, and if not, they can venture in and right it," VedBrat said.

On the ball

Research from TABB Group prior this year has, indeed, recommended that the purchase side is somewhat on top of things as far as AI reception contrasted with the sell-side and trade administrators.

Over 80% of the benefit the board respondents expressed that they were at any rate in the arranging or research period of actualizing AI, contrasted with 73% of their sell-side partners and trade administrators.

In the meantime, over 60% of purchase siders said they anticipate that spending on AI should increment through the span of this current year.

As indicated by the examination, most advantage directors concur that significant understanding is the greatest advantage of sending AI innovation, trailed by expanded proficiency and computerization, methodology choice and hazard the board.

In any case, there is a bogus observation can now and again be that AI and ML are moderately new to institutional exchanging; actually, both purchase and sell-side associations have been investigating, creating and actualizing such advancements for a long time now.

"The key takeaway from the majority of this is most capital market members are bullish on the utilization of AI and huge information sooner rather than later. It is high on the change plan all things considered firms, with the main use case being around the speculation procedure, yet in addition in exchange execution and activities," the exploration from TABB Group finished up.

Similarly as with most innovation slants however, the metaphor has a method for commanding the talk.

Correspondingly to the way blockchain detonated into the money related markets' awareness in 2016, AI and ML have moved toward becoming industry popular expressions, or at any rate a deceptive shorthand, those dangers exaggerating useful applications.

Ian McWilliams, venture examiner at Aberdeen Asset Management, detailed how the comprehension of what ML advancements are fit for is being twisted by an absence of comprehension and embellishment, during a board talk at TradeTech FX Europe toward the finish of a year ago.

"I joke that when you are publicizing remotely you state AI, however inside you state AI and really you are simply doing calculated relapse and things like that," he said. "I don't feel that is deceitful, possibly it's a touch of an overstatement, however, it's not off-base regarding definitions since when we talk about AI it truly is anything where you are getting a calculation to gain from the information.

"We're taking a ton of market sign and estimation signals, gauging what markets will do later on and utilizing those to fabricate exchanging techniques."

McWilliams explained that the publicity around components of ML, for example, profound learning, picture acknowledgment and common language preparing (NLP) is contorting desires around what are basic devices to all the more likely model information for exchanging methodology choices, especially with regards to discussions with reserve administrators.

"The intriguing thing we have to consider as an industry and perhaps where frames of mind need to change is around interpretability of the models, which is a central issue in plenty of territories, not simply fund," he said.

"At whatever point we turn out with an exchange an inquiry we get posed by the conventional store directors is 'For what reason is it making that exchange?' and they, by and large, expect an easygoing, A to B clarification, yet that regularly invalidates the purpose of these perplexing calculations.

The center ground isn't sufficient to simply say that the calculation says to do it, so we are doing it, however, there should be more discussion between the quant individuals and increasingly conventional individuals to comprehend there is an exchange off there."

Past the center office

As resource chiefs keep on trying different things with AI and ML, the objective has consistently been to robotize manual and frequently redundant assignments for more noteworthy productivity and cost investment funds, saving time for brokers to concentrate on all the more squeezing errands or complex request stream.

Be that as it may, as indicated by market members and technologists, the utilization of AI and ML components are currently saturating into progressively complicated pieces of the business.

AI and ML are starting to show esteem with regards to estimating and looking for liquidity, challenges that are frequently featured by purchase side merchants in the present economic situations.

"The straightforward exchange robotization, making guidelines to take a portion of the more fluid or simpler to exchange requests off the books, bodes well," said Ian Mawdsley, head of the purchase side exchanging for EMEA and APAC at Definitive, during an online class facilitated by The TRADE in March.

"Actually we have been utilizing both of these procedures [AI and ML] for quite a while. On the off chance that we take a gander at algo exchanging provided for the sell-side specifically, quite a bit of that was framed in any case to mechanize a portion of the more humble errands deals brokers were performing.

That has now been taken to the following level where individuals are taking a gander at value revelation and liquidity disclosure."

Further to this, taking a gander at the pragmatic utilization of AI and ML, a zone that has been quite compelling to the purchase side is the algo wheel or intermediary choice procedures. While an algo wheel is actually a type of AI, it is on the more essential, rules-based finish of the range, yet it provides a strong establishment to expand upon.

JP Morgan Asset Management has homed in on this space and delivered a structure, known as STARS (Systematic Trading Algorithm Recommendation System), which aims to enhance the manner by which brokers pick calculations utilizing ML innovation.

As indicated by the association's worldwide head of value exchanging mechanization and execution, Ashwin Venkatraman, the tremendous measures of information now available in the market supports and is at the core of actualizing these new apparatuses on the exchanging work area.

"We've had [STARS] since 2017, we've had 90% of our calculation positions, even in those days, experiencing the structure and we are moving it out all around too," Venkatraman said on the online course close by Definitive. "From various perspectives, we have been there and we've been upgrading that wheel after some time.

We are attempting to consider this all the more comprehensively. It's extremely about being information-driven as in any place we see all elements of exchanging, there are various viewpoints to it and it is tied in with attempting to use that information in the most fitting manner."

Participating in a keynote exchange at the current year's TradeTech meeting, Antish Manna, head of execution investigate at MAN GLG, said that the firm went live with an AI-based structure for request stream and dealer assignment a year ago.

"This structure adequately removes the requirement for a human to set a discretionary focus for 'my initial three representatives will get this measure of stream' and constantly refreshing that objective to having a machine that naturally does that", Manna explained.

"Its magnificence is that it turns into an extremely spotless discussion with our merchants; they know how we are getting along things and that they will get more stream, and this apparatus additionally adjusts to changing economic situations."

Man and machine

Notwithstanding the majority of the potential advantages that might be acknowledged, there are noteworthy deterrents with regards to conveying AI or ML forms, mainly as consistence obstacles, straightforwardness concerns and the construct versus purchase problem that most firms will consider sooner or later during usage.

Firms are encouraged that they should draw in with consistency offices when undertaking any innovation venture, and the significance of ceaselessly evaluating the model to defeat a portion of those straightforwardness obstructions is vital.

The selection and fruitful utilization of AI or ML accompany a huge asset cost connected, and all things considered, firms that hoping to acknowledge snappy outcomes will be distressfully frustrated except if they are set up to make the long appearance.

Tending to these ridiculous desires, MAN GLG's Manna said that most of the time spent on AI tasks are utilized to clean information before innovative work can happen and that those organizations that are just currently beginning their voyage with AI ought to be not hoping to get brings about the present moment.

"In all actuality, it is a misrepresentation and it requires an enormous measure of investment to manufacture a system where you can convey things at scale that work," he said. "On the AI and AI side of things, issues are best explained by groups of individuals, since you need the test, thoroughness and time to learn and fail, learn and attempt again; that procedure takes a ton of time."

Another noteworthy test is in finding the correct harmony among man and machine, as market members and technologists endeavor to scatter the fantasy that AI and ML are even near supplanting the human purchase side broker.

"In fact, there is a touch of truth that everything could be mechanized, there is no uncertainty that most procedures could be kept running without a person, certainly inside our industry," Mawdsley explained.

"The fact of the matter is that the world isn't that level and there are certainly uncommon things that occur in life consistently that don't pursue the examples and I don't know that we are 100% there, where the AI can translate those dark swan occasions and incorporate them with a model.

"There is a component that says the human brain is trained to manage these exceptions, and the machine offering assistance to pursue those examples is most likely where you need to be… It's tied in with utilizing innovation to settle on progressively educated exchanging choices and all things considered that implies not completely mechanizing everything at all and guaranteeing that we are getting a component of human intelligence, yet we are giving individuals alternatives."

As information turns out to be all the more promptly available and the size of that information keeps on developing, there is little uncertainty that benefits supervisors executing AI and ML advancements are at the bleeding edge of things to come of purchase side exchanging, and this is occurring now.

As a certain subsidizes battle to adjust to the changing exchanging scene, others are prepared and willing to take advantage of the lucky break utilizing AI and ML to redesign conventional exchanging forms.

Faster Financial News & Market Quotes - www.fastbull.com

Why don't many people post their daily winning results?

MT4talk PRO members can Turn off MT4talk daily winning result post requirements for $49.99 / month. More info...

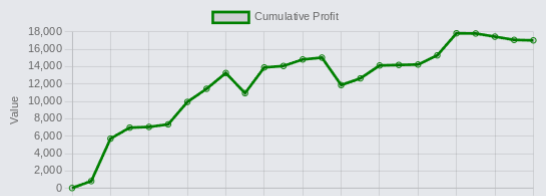

Latest profit posts from the Trade Executor EA users.

By using the MT4talk website, you automatically agree to the Forum Rules & Terms of Use, as well as the terms below.

Everything you see on the MT4talk website is created by its users, mainly the members of the MT4talk forum, as well as the forum administrators.

What is MT4talk?

MT4talk is an online Forex forum with over 5000 Forex robots and over 3000 Forex indicators uploaded by forum members in the last 10 years, available to download from forum posts. The uploaded files do not come with support or any guarantee.

The website does not sell Forex robots and does not provide support for any downloaded Forex robots. MT4talk offers a PRO membership, allowing you to download unlimited files from forum posts. If you choose to download a Forex robot from the forum, you do so at your own risk.

The MT4talk Team also provides an Artificial Intelligence Forex robot called "Trade Executor EA," which can be downloaded by PRO members, just like any other Forex robot on the forum. This Forex robot is only a bonus and is not included in the original PRO membership.

MT4talk is an informational website and does not guarantee the performance, profitability, or reliability of any Forex robot available for download. Updates for Forex robots may be limited or nonexistent, depending on the creator. If you choose to download any Forex robot or setting file from the forum, you acknowledge that you are using it at your own risk. MT4talk PRO membership is a digital product. Therefore, after you complete the PRO membership purchase, there is no refund available!

We are conducting real-life tests on Forex robots to assess their performance. For certain robots, we may use a demo account to conduct tests, and for other Forex robots, we may use a real Forex account. It's essential to recognize that we are not financial advisors and cannot provide investment guidance. Our objective is to discover effective market analysis solutions through testing various strategies, which could be beneficial to our community.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members or the MT4talk EA Tester Team about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

Affiliates Disclaimer - The website may have links to partner websites, and if you sign up and trade through these links, we will receive a commission. Our affiliate partners are FXOpen, FBS, Plexytrade, and MyForexVPS.

Copyright MT4talk.com Forum Rules - Privacy Policy.