Log in or register to download unlimited Forex robots!

Lesson 20: How Does Fundamental Analysis Impact Forex Trading?

Understanding Fundamental Analysis

Fundamental Analysis in Forex trading is all about analyzing the economic, social, and political factors that can affect currency values. Think of it as examining the health of a country's economy to predict whether its currency will strengthen or weaken.

Key Components of Fundamental Analysis

Economic Indicators

These are reports and data released by a country's government or private sector that give insights into how the economy is performing.

Common indicators include:

GDP (Gross Domestic Product): Shows the total value of all goods and services produced over a specific period.

Unemployment Rate: Indicates the percentage of the workforce that is unemployed and actively seeking employment.

Inflation Rates: Reflects the rate at which prices for goods and services are rising.

Political Events: Changes in political leadership, elections, and geopolitical tensions can have a significant impact on a country's currency.

Central Bank Policies: Decisions made by central banks, like changing interest rates or implementing new monetary policies, are powerful drivers of currency movements.

How to Use Fundamental Analysis

- Keep an eye on economic calendars that list upcoming events and indicators. Websites like Investing.com or ForexFactory.com provide comprehensive economic calendars.

- Learn how different indicators affect the currency. For example, a higher than expected GDP might strengthen a country’s currency as it suggests a healthy economy.

- Major economic announcements can lead to significant volatility. It’s essential to be aware of these times so you can manage your trades accordingly.

- While fundamental analysis gives you the ‘why’, technical analysis can help with the ‘when’. Combining these two can enhance your trading strategy.

Real-Life Example

Let's say the U.S. Federal Reserve announces an increase in interest rates. This typically leads to a stronger U.S. Dollar as higher rates offer better returns on investments in USD. As a Forex trader, anticipating this move could lead you to buy USD against other currencies before the announcement, aiming to profit from the subsequent rise in USD value.

1. Dynamic Approach

Think of Forex trading as a complex field where traders constantly adjust their strategies based on various global factors. These factors can include economic policies, political events, and even natural disasters. There's no fixed list of factors that always apply because the financial world is always changing.

2. Exchange Rates and Their Complexity

In Forex, determining the value of a currency against another is not straightforward. It's not like a simple math problem with one right answer. Factors influencing exchange rates are numerous and often conflicting, making it challenging to predict currency movements accurately.

3. Purchasing Power Parity (PPP): The Basic Idea and Its Limitations

PPP is a theory that tries to determine the fair value of currencies. It suggests that currencies should balance out based on the cost of goods and services in different countries. However, this theory oversimplifies things. Countries have different strengths, like cheaper production costs or unique products, which PPP doesn't fully account for. Also, people's preferences for local products and the impact of services that can't be traded internationally (like a restaurant meal in your hometown) complicate this theory further.

4. PPP in Practice: Not a Trading Tool

While the Big Mac index is an interesting way to look at currency values, it's not used for actual trading decisions. Currency markets are influenced by many factors, and sometimes governments intentionally change their currency's value. This means that PPP, while interesting, doesn't provide a reliable basis for trading.

5. Interest Rate Parity: A Useful Concept with Limitations

This concept suggests that differences in interest rates between countries should balance out through changes in currency values. But it doesn't always work perfectly in practice. Factors like different risks associated with investing in different countries and the attractiveness of various investment options can influence currency values beyond just interest rate differences.

6. Carry Trade: High Reward, High Risk

In carry trade, traders borrow money in a country with low interest rates and invest it in a country with high interest rates to profit from the difference. It's a strategy that can be profitable, but it's risky. Sudden changes in the market can lead to big losses.

7. Risk Sentiment and Currency Values

The overall mood or sentiment in the market can greatly affect currency values. For example, if traders are worried about the stability of a country or a region, they might sell off that country's currency, leading to a decrease in its value. This sentiment can change quickly based on new information or events.

8. Inflation and Central Bank Policies

Inflation, which is the rate at which prices for goods and services rise, can affect a currency's value. Generally, higher inflation can lead to a decrease in currency value. But central banks, which control monetary policy, look at more than just inflation. They also consider the overall health of the economy, employment levels, and other economic indicators when making decisions that can affect currency values.

In summary, Fundamental Analysis in Forex trading involves keeping track of a wide range of factors that can influence currency values. It requires staying informed about global events, economic policies, and market trends.

Why don't many people post their daily winning results?

MT4talk PRO members can Turn off MT4talk daily winning result post requirements for $49.99 / month. More info...

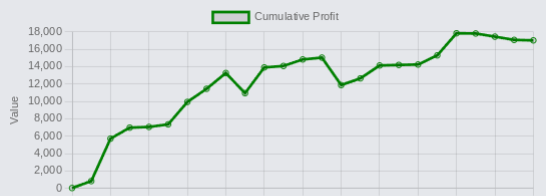

Latest profit posts from the Trade Executor EA users.

By using the MT4talk website, you automatically agree to the Forum Rules & Terms of Use, as well as the terms below.

Everything you see on the MT4talk website is created by its users, mainly the members of the MT4talk forum, as well as the forum administrators.

What is MT4talk?

MT4talk is an online Forex forum with over 5000 Forex robots and over 3000 Forex indicators uploaded by forum members in the last 10 years, available to download from forum posts. The uploaded files do not come with support or any guarantee.

The website does not sell Forex robots and does not provide support for any downloaded Forex robots. MT4talk offers a PRO membership, allowing you to download unlimited files from forum posts. If you choose to download a Forex robot from the forum, you do so at your own risk.

The MT4talk Team also provides an Artificial Intelligence Forex robot called "Trade Executor EA," which can be downloaded by PRO members, just like any other Forex robot on the forum. This Forex robot is only a bonus and is not included in the original PRO membership.

MT4talk is an informational website and does not guarantee the performance, profitability, or reliability of any Forex robot available for download. Updates for Forex robots may be limited or nonexistent, depending on the creator. If you choose to download any Forex robot or setting file from the forum, you acknowledge that you are using it at your own risk. MT4talk PRO membership is a digital product. Therefore, after you complete the PRO membership purchase, there is no refund available!

We are conducting real-life tests on Forex robots to assess their performance. For certain robots, we may use a demo account to conduct tests, and for other Forex robots, we may use a real Forex account. It's essential to recognize that we are not financial advisors and cannot provide investment guidance. Our objective is to discover effective market analysis solutions through testing various strategies, which could be beneficial to our community.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members or the MT4talk EA Tester Team about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

Affiliates Disclaimer - The website may have links to partner websites, and if you sign up and trade through these links, we will receive a commission. Our affiliate partners are FXOpen, FBS, Plexytrade, and MyForexVPS.

Copyright MT4talk.com Forum Rules - Privacy Policy.