Log in or register to download unlimited Forex robots!

Basic Concepts VII: Margin

What is Margin?

Margin is the amount of equity that must be maintained in a trading account to keep a position open. It acts as a good faith deposit by the trader to ensure against trading losses. A margin account allows customers to open positions with higher value than the amount of funds they have deposited in their account.

Trading a margin account is also described as trading on a leveraged basis. Most online forex firms offer up to 200 times leverage on a mini contract account. The mini contract size is usually 10,000 currency unit, 1/200th of 10,000 equals to 50 currency unit, meaning only 0.5% margin is required for open positions. Compare to future contracts, which require 10% margin for most contracts, and equities require 50% margin to the average investor and 10% margin to the professional equity traders, foreign exchange market offers the highest leverage among the other trading instruments.

The equity in excess of the margin requirement in a trading account acts as a cushion for the trader. If the trader loses on a position to the point that equity is below the minimum margin requirement, meaning the cushion has completely worn out, then a margin call will result. Generally, in online forex trading, the trader must deposit more funds before the margin call or the position will be closed. Since no calls are issued before the liquidation, the margin call is better known as ‘margin out' in this case. The account will be margined out, meaning all the positions will be closed, once the equity falls below the margin requirement.

Example:

Account A

Account Equity 500USD

Contract Size 10,000

Currency EUR/USD

Spread 3 pips

Margin Requirement 50USD

Leverage 1,000:50 = 200:1

Pips to margin out (1 lot) 447

Consider Account A, the margin requirement for 1 lot of position is 50USD. The free usable margin is Account Equity - (Margin Requirement + Spread) = 500 - (50 + 3) = 447. The account will be margined out if EUR/USD moves 447 pips against the position.

Why Margin Requirement Matters?

Leverage is a double-edged sword. With proper usage, it can enhance customers' funds to generate quick returns and increase the potential return of an investment. However, without proper risk management, it can lead to quick and large losses. Consider the following example:

Account A B

Account Equity 500USD 500USD

Contract Size 10,000 10,000

Currency EUR/USD EUR/USD

Spread 3 pips 3 pips

Margin Requirement 50USD 200USD

Leverage 1,000:50 = 200:1 1,000:200 = 50:1

Pips to margin out (1 lot) 447 297

Max no. of lots at one time 9 2

Pips to margin out (max lots) 3 47

The initial conditions of the accounts are the same, except for account A, the margin requirement per lot is 50USD and account B is 200USD.

Free usable margin = Account Equity - (Margin Requirement + Spread)*no. of lots

Maximum number of lots open at one time = Account Equity / (margin requirement + spread)

In account A, for 1 lot of position, the free usable margin is 500 - (50+3) = 447, which means the account will be margined out if EUR/USD moves 447 pips against the position. The max number of lots open at one time = (500/(50+3)) = 9 lots, with 500 - (50+3)*9 = 23USD free usable margin left for 9 lots. Once EUR/USD moves 23/9 = 3 pips against the positions, there would be not enough usable margin and account A will be margined out.

In account B, the free usable margin for 1 lot is 500 - (200+3) = 297, which means the account will be margined out if EUR/USD moves 297 pips against the position. The max number of lots open at one time = (500/(200+3)) =2 lots, with 500 - (200+3)*2 = 94USD free usable margin for 2 lots. If EUR/USD moves 94/2 = 47 pips against the positions, account B would be margined out.

With 1 lot of open position, account A has 447USD usable margin as cushion before being margined out, while account B only as 297USD. However, with more usable margin, account A has higher probability of being over traded. As shown in the above example, the more open positions, the easier is the account to get margin out.

Most forex trading firms offer customizable leverage; traders can choose the leverage ratio they feel most comfortable with. Customers should be aware of how to guard against over trading an account and managing overall risk.

Why don't many people post their daily winning results?

MT4talk PRO members can Turn off MT4talk daily winning result post requirements for $49.99 / month. More info...

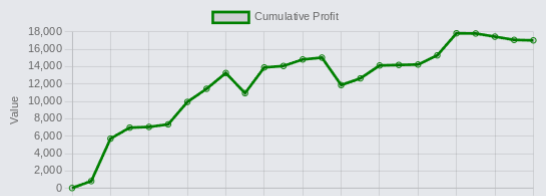

Latest profit posts from the Trade Executor EA users.

By using the MT4talk website, you automatically agree to the Forum Rules & Terms of Use, as well as the terms below.

Everything you see on the MT4talk website is created by its users, mainly the members of the MT4talk forum, as well as the forum administrators.

What is MT4talk?

MT4talk is an online Forex forum with over 5000 Forex robots and over 3000 Forex indicators uploaded by forum members in the last 10 years, available to download from forum posts. The uploaded files do not come with support or any guarantee.

The website does not sell Forex robots and does not provide support for any downloaded Forex robots. MT4talk offers a PRO membership, allowing you to download unlimited files from forum posts. If you choose to download a Forex robot from the forum, you do so at your own risk.

The MT4talk Team also provides an Artificial Intelligence Forex robot called "Trade Executor EA," which can be downloaded by PRO members, just like any other Forex robot on the forum. This Forex robot is only a bonus and is not included in the original PRO membership.

MT4talk is an informational website and does not guarantee the performance, profitability, or reliability of any Forex robot available for download. Updates for Forex robots may be limited or nonexistent, depending on the creator. If you choose to download any Forex robot or setting file from the forum, you acknowledge that you are using it at your own risk. MT4talk PRO membership is a digital product. Therefore, after you complete the PRO membership purchase, there is no refund available!

We are conducting real-life tests on Forex robots to assess their performance. For certain robots, we may use a demo account to conduct tests, and for other Forex robots, we may use a real Forex account. It's essential to recognize that we are not financial advisors and cannot provide investment guidance. Our objective is to discover effective market analysis solutions through testing various strategies, which could be beneficial to our community.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members or the MT4talk EA Tester Team about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

Affiliates Disclaimer - The website may have links to partner websites, and if you sign up and trade through these links, we will receive a commission. Our affiliate partners are FXOpen, FBS, Plexytrade, and MyForexVPS.

Copyright MT4talk.com Forum Rules - Privacy Policy.