Log in or register to download unlimited Forex robots!

FOREX-Dollar recovers from post-U.S. payrolls wobble, seen sideways for now

* Dollar regains composure after post-U.S. payrolls fall

* Norwegian crown choppy after local inflation data

* U.S. bond market closed Tuesday for Veterans Day

By Ian Chua

SYDNEY, Nov 11 (Reuters) - The dollar started trade in Asia with a bid tone, having reversed some of its post-payrolls losses as investors were quick to rebuild long positions amid an absence of major drivers.

It was back near 115.00 yen and not far off Friday's seven-year peak of 115.60, after recovering from a dip to 113.86. The greenback also climbed on the euro, which eased to $1.2421 from above $1.2500.

That caused the dollar index to bounce to 87.820 and within striking distance of a four-year high of 88.190.

Investors had taken profits on extremely long dollar positions on Friday after headline U.S. payroll figures missed more optimistic expectations. The report, however, still painted an encouraging picture of the U.S. labour market.

"USD buyers took advantage of the post-NFP dip to build on longs," Elsa Lignos, senior currency strategist at RBC Capital Markets, wrote in a note to clients.

"We argued that relative to anything other than rather bloated expectations, Friday's payrolls report was a solid release and we prefer to fade USD weakness this week."

Indeed, the closely watched nonfarm payrolls only served to highlight the much brighter U.S. economic outlook compared with Europe and Japan.

The resultant diverging monetary policy pathways between the Federal Reserve and its major counterparts have been a key driver of the dollar against the euro and the yen in the past few months.

Yet with U.S. inflation tame, commodity prices falling and global growth expectations weak, markets have resisted bringing forward the likely timing of a U.S. interest rate hike. Many analysts still see mid-2015 as a possible window for the first tightening since 2006.

For some traders, expectations for that kind of policy normalisation need to heat up for more substantial dollar gains.

Boston Federal Reserve bank President Eric Rosengren on Monday repeated his call for the Fed to remain patient in raising rates until it is more certain that inflation will rise to the Fed's target.

Monday's bounce in the dollar caused commodity currencies to beat a hasty retreat. The Australian dollar eased to $0.8622 from $0.8684, while its New Zealand peer dipped to $0.7750 from $0.7823.

The Norwegian crown was a standout currency after inflation data at home surprised on the upside. It briefly strengthened against both the euro and dollar before giving up most of the gains.

The euro last traded at 8.4623 crowns, having fallen as far as 8.4100.

Trading in Asia is expected to be subdued with no major economic news. U.S. bond market and government offices will be closed on Tuesday for the Veterans Day holiday. (Editing by Dan Grebler)

AUD/USD: Forecast revised lower, sub 0.80 end of 2015 - NAB

FXStreet (Bali) - NAB FX Strategists have revised the Australian Dollar forecast lower, now seen sub US 80 cents by end of 2015/early 2016.

Key Quotes

"Our FX Strategy team revised their AUD/USD forecasts lower. The key points are: “The speed with which the USD/JPY run-up has broadened out into a more generalised bout of USD appreciation, means that many of the levels for major US dollar pairs we thought would be achieved only in 2015, are being realised much sooner."

"We tentatively suggest AUD/USD could end this year in the 85-86 area, but the risk is clearly skewed towards a clean break below 85 in a continued stronger dollar environment. We also now suggest that the eventual low in AUD/USD will be below 80 cents (we forecast 0.80 in late 2015/early 2016 and a low of 0.78 in H2 2016)."

"Our expectation that Australia’s Terms of Trade will find a base above its long term average, and that a relative shallow Fed tightening cycle will be a restraining influence on the extent of ultimate US dollar appreciation, means we do not think the AUD will trade back to – or through – its historical post-float average of around 76 cents."

Fed's Rosengren: USD appreciation not a concern

FXStreet (Bali) - Boston Federal Reserve President Eric Rosengren, in the Q&A session after his earlier speech, said, via Reuters, that recent appreciation of the US dollar is not a concern to him, adding that divergent US and Europe growth will impact dollar.

Gold Exposed As USD Bulls Return, WTI Tests Key 77.00 Barrier

Talking Points

Gold & Silver Remain At Risk As The US Dollar Bulls Return In NFP Aftermath

Crude Oil May Face Further Pressure As Supply Glut Concerns Linger

Gold RemainsVulnerable To USD Strength Over Q4 – Quarterly Forecast

Crude oil resumed its descent on Monday with newswires suggesting speculation over ample global supplies as the likely driver. Over the session ahead such concerns could continue to keep pressure on the commodity, with a light US docket unlikely to offer positive demand-side cues.

Also in the energy space; natural gas suffered a sharp retreat of over 2 percent in recent trade. Media sources cited anticipation of milder US weather conditions as a catalyst behind the fall from its multi-month high. As noted in recent reports the sustainability of natural gas’ ascent was questionable in the face of above-average storage builds.

Finally, the precious metals saw renewed downside momentum at the outset of the week as the US Dollar bulls returned. Traders have had some time to digest Friday’s disappointing headline NFPs print, and have likely recognized that it does not materially alter the prospect of Fed policy normalization. This in turn is USD positive and could keep gold and silvertrading heavy in the near-term.

Heads Up: Oct UK BRC Sales Like-For-Like data due at 00:01 GMT (15min). -0.5% expected vs -2.1% y/y in Sep.

Heads Up: RBA's Aymler presents a speech at Secruitization Conference at 00:10 GMT (15min).

Australia Econ: 3Q House Price Index 9.1% y/y and 1.5% q/q vs 8.8% y/y and 1.5% q/q expected vs 10.1% and 1.9% prior respectively.

Precious Metals Update (USD): Gold 1153.44 (+0.14%); Silver 15.59 (-0.15%), Platinum 1200.75 (+0.23%); Palladium 766.16 (+0.37%).

FOREX-Dollar steadies from payrolls wobble, Aussie firmer on house data

* Dollar rangebound with U.S. bond market closed Tuesday

* Decent local housing data gives Aussie a breather

* Norwegian crown choppy after local inflation data (Adds details, quotes)

By Shinichi Saoshiro and Ian Chua

TOKYO/SYDNEY, Nov 11 (Reuters) - The dollar steadied on Tuesday after recouping some of its post-payrolls losses as an uptick in risk appetite sent U.S. Treasury yields higher and underpinned Wall Street stocks.

The greenback kept to a narrow range with the U.S. bond market - a key driver of the currency - closed on Tuesday for the Veterans Day holiday.

"The dollar's latest bounce owes a lot to the spike in U.S. bond yields, and with the (U.S.) fixed income market closed today the currency's advance has bogged down. It has also been capped by the Australian dollar's rise on stronger than expected local housing data," said Junichi Ishikawa, a market analyst at IG Securities in Tokyo.

The dollar stood little changed at 114.765 yen after bouncing from 113.86 hit late last week when U.S. payroll data failed to live up to more optimistic expectations. It was still some distance from a seven-year peak of 115.60 scaled last week.

The Aussie was up 0.3 percent at $0.8649 after Australian home prices showed a 1.5 percent rise in the third quarter, giving the beleaguered currency some respite.

The antipodean currency had fallen to a four-year low of $0.8540 late last week as declining commodity prices clouded prospects for the Australian economy.

The euro gained 0.1 percent to $1.2435, edging away from a two-year trough of $1.2358 touched last week.

The Norwegian crown was a standout currency after inflation data at home surprised on the upside. It briefly strengthened against both the euro and dollar before giving up most of the gains.

The euro last traded at 8.4614 crowns, having fallen as far as 8.4100.

The common currency had risen to a five-year high of 8.679 crowns last week on the back of a decline in the price of crude oil - Norway's main export.

DOLLAR LONGS

The market looked ahead to a batch of key U.S. data releases towards the week's end that may further underscore the brighter U.S. economic outlook relative to Europe and Japan. U.S. indicators due Friday include retail sales and consumer sentiment data.

"USD buyers took advantage of the post-NFP dip to build on longs," Elsa Lignos, senior currency strategist at RBC Capital Markets, wrote in a note to clients.

"We argued that relative to anything other than rather bloated expectations, Friday's payrolls report was a solid release and we prefer to fade USD weakness this week."

Diverging monetary policy pathways between the Federal Reserve and its major counterparts like the Bank of Japan, which surprised the markets by easing monetary policy further last month, have been a key driver of the dollar against the euro and the yen in the past few months.

Yet with U.S. inflation tame, commodity prices falling and global growth expectations weak, markets have resisted bringing forward the likely timing of a U.S. interest rate hike. Many analysts still see mid-2015 as a possible window for the first tightening since 2006. (Editing by Dan Grebler & Shri Navaratnam)

AUD/USD: Q Wage price readings might carry a potential event risk - OCBC Bank

FXStreet (Barcelona) - Emmanuel Ng, FX Strategist at OCBC Bank notes that the Q wage price readings may push the pair below 0.8500 levels.

Key Quotes

"Expect the antipodeans to be relatively muted pending further global cues (especially on the growth front) despite the better than expected October NAB business conditions index this morning."

"Going ahead, we think markets would require another catalyst to push the pair to sub-0.8500 levels, with 3Q wage price readings a potential event risk. Stay top-heavy on the pair in the interim."

By using the MT4talk website, you automatically agree to the Forum Rules & Terms of Use, as well as the terms below.

Everything you see on the MT4talk website is created by its users, mainly the members of the MT4talk forum, as well as the forum administrators.

What is MT4talk?

MT4talk is an online Forex forum with over 5000 Forex robots and over 3000 Forex indicators uploaded by forum members in the last 10 years, available to download from forum posts. The uploaded files do not come with support or any guarantee.

The website does not sell Forex robots and does not provide support for any downloaded Forex robots. MT4talk offers a PRO membership, allowing you to download unlimited files from forum posts. If you choose to download a Forex robot from the forum, you do so at your own risk.

The MT4talk Team also provides an Artificial Intelligence Forex robot called "Trade Executor EA," which can be downloaded by PRO members, just like any other Forex robot on the forum. This Forex robot is only a bonus and is not included in the original PRO membership.

MT4talk is an informational website and does not guarantee the performance, profitability, or reliability of any Forex robot available for download. Updates for Forex robots may be limited or nonexistent, depending on the creator. If you choose to download any Forex robot or setting file from the forum, you acknowledge that you are using it at your own risk. MT4talk PRO membership is a digital product. Therefore, after you complete the PRO membership purchase, there is no refund available!

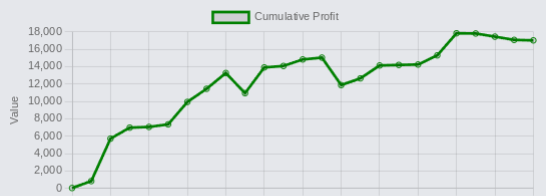

We are conducting real-life tests on Forex robots to assess their performance. For certain robots, we may use a demo account to conduct tests, and for other Forex robots, we may use a real Forex account. It's essential to recognize that we are not financial advisors and cannot provide investment guidance. Our objective is to discover effective market analysis solutions through testing various strategies, which could be beneficial to our community.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members or the MT4talk EA Tester Team about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

Affiliates Disclaimer - The website may have links to partner websites, and if you sign up and trade through these links, we will receive a commission. Our affiliate partners are FXOpen, FBS, Plexytrade, and MyForexVPS.

Copyright MT4talk.com Forum Rules - Privacy Policy.