Log in or register to download unlimited Forex robots!

Australian Dollar Rises As Business Conditions Improves By Record Margin

11/10/2014 11:58 PM ET

The Australian dollar strengthened against the other major currencies in the Asian session on Tuesday after data showed that business conditions improved notably.

Data from National Australia Bank showed that business conditions in Australia surged last month- climbing from +1 in September to a six-year high of +13.

But business confidence slid slightly in October, with the index easing to +4 from +5 in September.

Data from the Australian Bureau of Statistics showed that house prices in Australia advanced 1.5 percent on quarter in the third quarter of 2014 - in line with expectations and slowing from the 1.8 percent gain in the second quarter.

On a yearly basis, house prices jumped 9.1 percent - exceeding forecasts but down from 10.1 percent in the previous month.

In the New York session overnight, the Australian dollar held steady against the other major currencies. Nevertheless, the Australian dollar was slightly weaker against other major currencies on Monday.

The Australian dollar rose to a 6-day high of 99.23 against the yen and a 4-day high of 0.9833 against the Canadian dollar in the Asian session, from yesterday's closing quotes of 99.00 and 0.9806, respectively. If the aussie extends its uptrend, it is likely to find resistance around 100.00 against the yen and 0.99 against the loonie.

Against the euro, the U.S. and NZ dollars, the aussie edged up to 1.4375, 0.8649 and 1.1142 from yesterday's closing quotes of 1.4398, 0.8619 and 1.1121, respectively. The aussie may test resistance near 1.42 against the euro, 0.87 against the greenback and 1.128 against the kiwi.

Looking ahead, Japan consumer confidence index, the results of Eco Watchers survey and machine tool orders- all for October are due shortly.

AUD/USD: Soft data Q3 data will fuel the bears - FX Charts

FXStreet (Barcelona) - Jim Langlands of FX Charts views soft house price index and NAB business confidence data adding further pressure to the downside.

Key Quotes

“The Q3 house price index and the NAB business confidence/conditions data are due (and maybe Chinese New Loans) and if soft will add further pressure to the downside.”

“Below 0.8600 would see a run towards 0.8570 and then possibly to last week’s low at 0.8540. As we said yesterday, this will provide very strong support, being both 50% of the move from 0.6006/1.1082 and also the base of the monthly cloud. A break of this level though, and a November close below it, would have very bearish implications, for a test of the major channel base at around 0.8474 and then the May 2010 lows at 0.8066”

Dollar Rises Versus Majors as Correlation to S&P 500 Builds

Talking Points:

Dollar Rises Versus Majors as Correlation to S&P 500 Builds

Euro Steady Despite Painful Investor Sentiment, Slowing Stimulus

British Pound Counting Down the Hours to Volatility

Dollar Rises Versus Majors as Correlation to S&P 500 Builds

The Dow Jones FXCM Dollar Index (ticker = USDollar) posted a modest advance to start the week. Yet, where its drive was measured, its breadth was impressive. The greenback managed gains against all of its major counterparts. With FX Volatility still elevated and the market’s rate forecasts still recovering, there is a steady bullish track beneath the benchmark currency. What makes the currency’s current performance truly remarkable though is its relationship to the S&P 500 – a benchmark for sentiment. Though the two can (and have) risen and fallen in tandem in the past, the short-term two-week (10-day relationship between safe haven currency and ‘risk’ benchmark has hit an incredible 0.95. That is the strongest positive relationship between the two since March of 2003. With any meaningful shift in speculative positioning – whether bullish or bearish – this relationship will flip once again; but status quo is clearly feeding two very established trends.

Euro Steady Despite Painful Investor Sentiment, Slowing Stimulus

The news crossing the euro’s wires to start the week were far from flattering. On the economic front, the Bank of Italy reported a 19.7 percent increase in bad loans and Greece industrial production shrunk a more-than-expected 5.1 percent. From a monetary policy perspective, the slower pace of covered-bond purchases by the ECB was not well padded by central banker Mersch’s suggestion that ABS (asset backed securities) buying could begin next week. The most interesting piece of event risk though was the Sentix investor sentiment survey. Though it didn’t hit a new low for the fourth consecutive month, the trend is firmly in the bears’ domain. This and the ZEW investor confidence readings are good leading proxies for actual positioning in the region’s capital markets. An outflow of capital from the Euro-area holds far greater potential for further currency losses than an upgrade in stimulus (which is now heavily priced in) going forward.

British Pound Counting Down the Hours to Volatility

In the lead up to major event risk, we typically see trading activity thin out. Few traders take large trades knowing that a single event can usher instant and painful losses with an unfavorable outcome. That said, a shallower pool can also leverage the influence of those that are oblivious to the risk or simply want to take advantage of the conditions. In other words, be wary of any abrupt moves that happen in the lead up to the Bank of England’s Quarterly Inflation Report. The previous four assessments of economic health and forecasts for interest rates generated heavy volume and volatility. This round finds the market more on edge about UK rates than ever.

Yen Crosses Consolidate, Volatility Expectations Drop

After the initial flush of surprise that followed the Bank of Japan’s upgrade to its stimulus program the Friday before last, the Yen crosses have found it difficult to keep momentum running. A quick adjustment to the unexpected was inevitable, but follow through is the measure of whether an upgrade on the dovish efforts of the Japanese authority can leverage the same kind of influence it carried between 3Q 2012 and mid-2013. These pairs are not coming off record lows and carry is still extremely low. Oddly enough though, volatility expectations for reversal are low.

New Zealand Dollar: Financial Stability Report an Opportunity to Boost Stimulus?

The Reserve Bank of New Zealand’s (RBNZ) is scheduled to release its Financial Stability Report in the upcoming session (at 20:00 GMT). Normally, this assessment would be analyzed with a critical but sedate eye. This time around, however, traders are working off a backdrop where central bankers are growing emboldened in their policy efforts. If the Governor Wheeler and crew believe the risks to the region’s financial safety are in jeopardy, it may prove yet another reason for the central bank to escalate its effort to drive down an “over-valued” currency.

Emerging Markets Mixed, Russian Ruble Soars

Emerging Markets – much like other risk benchmarks – were relatively steady through the opening session of the week. The MSCI EM ETF posted a modest gain despite retracing most of its early session gains. The JPMorgan volatility index for the asset group would also offer up significant relief. The rankings for Monday’s session were mixed amongst the FX crowd with the Korean Won and Brazilian notable (if measured) gainers, while the Mexican Peso led for losses against the Dollar. The stand out amongst the crowd, however, was the Russian Ruble. The 2.4 percent surge was the second largest for the currency in two years. This retreat from record highs comes after Russian President Vladimir Putin opined that the currency’s losses had nothing to do with fundamentals and speculators driving the currency down would be punished. This was clarified and reinforced by Bank of Russia Governor Elvira Nabiullina who announced plans to limit Ruble funding to banks. This move comes against economic downgrades amid sanctions and fears of possible capital controls should this effort not work.

Gold Drops Sharply Follow Futures Bulls Biggest Exodus in 3 Years

Gold dropped 2.3 percent to open the trading week. While that is not in itself remarkable as far as records go – there have been comparable and larger declines are recently as last week – it is made more substantial that the retreat comes on a failed effort to retake $1,185. This former, four-year low is now standing as staunch resistance as investors look more critically at the fundamentals that would be needed to relaunch the bullish drive that fell apart in 2011. While the proliferation of stimulus has taken off with the ECB and BoJ’s efforts, the view that an ‘alternative to traditional fiat’ seems to be curbed by the strength of the Dollar. In the meantime, speculative appetite is starting to drop at a more exaggerated pace. Total ETF holdings of the precious metal dropped 1.4 percent this past week – the most since the final week of December while net long speculative futures holdings measured by the COT dropped the most since August 2011 (37,514 contracts).

Japanese govt sources say PM Abe likely to delay sales tax hike

GPIF started selling JGBs before official change of allocation

selling is continuing says a senior govt official

Rtrs reporting as USDJPY triggers the stops through 115.55 to post 115.81 in a rush

Why don't many people post their daily winning results?

MT4talk PRO members can Turn off MT4talk daily winning result post requirements for $49.99 / month. More info...

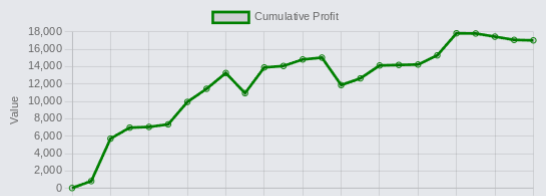

Latest profit posts from the Trade Executor EA users.

By using the MT4talk website, you automatically agree to the Forum Rules & Terms of Use, as well as the terms below.

Everything you see on the MT4talk website is created by its users, mainly the members of the MT4talk forum, as well as the forum administrators.

What is MT4talk?

MT4talk is an online Forex forum with over 5000 Forex robots and over 3000 Forex indicators uploaded by forum members in the last 10 years, available to download from forum posts. The uploaded files do not come with support or any guarantee.

The website does not sell Forex robots and does not provide support for any downloaded Forex robots. MT4talk offers a PRO membership, allowing you to download unlimited files from forum posts. If you choose to download a Forex robot from the forum, you do so at your own risk.

The MT4talk Team also provides an Artificial Intelligence Forex robot called "Trade Executor EA," which can be downloaded by PRO members, just like any other Forex robot on the forum. This Forex robot is only a bonus and is not included in the original PRO membership.

MT4talk is an informational website and does not guarantee the performance, profitability, or reliability of any Forex robot available for download. Updates for Forex robots may be limited or nonexistent, depending on the creator. If you choose to download any Forex robot or setting file from the forum, you acknowledge that you are using it at your own risk. MT4talk PRO membership is a digital product. Therefore, after you complete the PRO membership purchase, there is no refund available!

We are conducting real-life tests on Forex robots to assess their performance. For certain robots, we may use a demo account to conduct tests, and for other Forex robots, we may use a real Forex account. It's essential to recognize that we are not financial advisors and cannot provide investment guidance. Our objective is to discover effective market analysis solutions through testing various strategies, which could be beneficial to our community.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members or the MT4talk EA Tester Team about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

Affiliates Disclaimer - The website may have links to partner websites, and if you sign up and trade through these links, we will receive a commission. Our affiliate partners are FXOpen, FBS, Plexytrade, and MyForexVPS.

Copyright MT4talk.com Forum Rules - Privacy Policy.