Log in or register to download unlimited Forex robots!

British Pound Traders Brace for Volatility from BoE Report

Talking Points:

Dollar Drops as FX Volatility, Rate Forecasts Offset

British Pound Traders Brace for Volatility from BoE Report

Yen Crosses Rally as Market Speculates on Election, Tax Hike Delay

Dollar Drops as FX Volatility, Rate Forecasts Offset

The US Dollar took a modest spill versus most of its major counterparts this past session as moderation in rate speculation offset a jump in FX volatility. Two important themes have traded influence over the Greenback: investor sentiment and the yield advantage held over major counterparts. On the risk front, the standard-bearer S&P 500 tagged a fresh record high but did so on increasingly slower progress while volume showed the lowest turnover in 10 weeks. While this restraint was likely partly attributable to the Veteran’s holiday that closed fixed income exchanges, this projects a trend of moderation that we have seen develop shortly after the rebound began. Meanwhile, on the FX side, the currency market’s short-term (1-week) volatility reading jumped nearly 10 percent, and has made a similarly sized jump this morning. At 9.4 now, a move back towards 11 – the 12-month peaks set in September and opening week of November – could reinvigorate the Dollar.

However, waiting for ‘risk’ has proven a crap shoot for traders; and there is little in the way of definitive event risk that can be expected to generate a shock with enough mass to shift market-wide sentiment. In the meantime, rate speculation seems to be percolating. Both Fed Fund and Eurodollar futures slipped Tuesday, but overnight swaps with a 12-month outlook are hovering hawkishly around 50 bps. On the wires, both Dallas Fed President Fisher and Philly Fed President Plosser kept to their policy colors by both warning of risks associated with keeping rates too low for too long. Yet, the pull their views carry is likely tempered by the fact that bot is set to retire next year – neither would have been a voter in 2015 regardless. Ahead, we have some low-grade event risk, dove Kocherlakota is set to speak and there are a few shorter duration Treasury auctions. Heavier movements in the Pound, Euro and Yen would likely generate more Dollar movement.

British Pound Traders Brace for Volatility from BoE Report

Top event risk for the majors through the upcoming session is the Bank of England’s Quarterly Inflation Report. As important as monetary policy is for establishing the bearings and activity levels of currencies, the Sterling is notoriously short-changed for updates on this theme. The BoE does not offer a meaningful update after meetings that don’t result in policy change – and there hasn’t been an update in a while. Minutes offer more detail, but are still vague and are limited in forecast. The best updates for the policy group’s outlook comes with this periodical report. Compared to the burgeoning optimism and hawkish views in the updates through the second half of 2013 and first half of 2014, the last report took a more dovish tone. Furthermore, we have seen growth forecasts dim and policy officials have individually voiced a more balanced view with interviews. Given the GBPUSD’s trend these past four months and the still-hawkish lean behind market forecasts, a more timid outlook would generate a bigger (bearish) response. And, given its track record for impact, this event risk should be watched closely.

Yen Crosses Rally as Market Speculates on Election, Tax Hike Delay

Through the close of Tuesday’s session, the Yen suffered losses between 0.8 percent (versus the Dollar) and 1.6 percent (against the NZD). The impetus for this drop were rumors that the Japanese Prime Minister Shinzo Abe may soon have to call a snap election and/or that the second sales tax increase could be pushed back due to stagnant growth conditions. A mixture of uncertainty and a push towards implicit stimulus both stokes a tawdry appetite for risk while also undermining long-term confidence in Japan’s financial and fiscal health. Both drive the Yen lower (crosses higher). This morning, the market remains focused on this theme with Advisors speaking more belligerently.

Euro and European Markets Can’t Remain on Divergent Paths For Much Longer

Though its allegiances fluctuate, there is generally a strong relationship between EURUSD and general risk trends as well as the relative confidence in European capital markets. This is demonstrated when we overlay a chart of the exchange rate with the Euro Stoxx 50 equity index. Historically, the correlation tends to be strongly positive. Currently, that relationship (20-day, 1-month rolling correlation) is the most negative it has been since July of last year. The ECB’s efforts are forging this divergence, but global risk appetite will eventually reconcile them.

Australian and New Zealand Dollars Lead Majors Gains

Despite a measured performance in global equities performance, modest gains from the Deutsche Bank Carry Harvest index and a rise in FX volatility; the struggling carry currencies (Australian and New Zealand Dollars) generated the past session’s top performance. Both currencies have struggled against the US and European currencies these past months which may confera rebound through moderation. Because, neither their yield forecasts nor the appetite for carry seems to be providing a strong motivation for gains. In other words, be wary of follow through.

Emerging Markets: Has Russia’s Most Recent Move Stabilized the Ruble?

The MSCI Emerging Market ETF posted a modest decline on low volume this past session. From the FX range, the EM was once again an even split between moderate gains and losses. The biggest mover was once again the Russian Ruble. A 2.3 percent drop developed despite the Russian Central Bank’s recent efforts to try and stem capital outflow. Default swaps and volatility levels show the market is very dubious.

Gold Positioning Grows More Extreme Even as Prices Seem to Form Range

While gold offered up another switch back with its 1.1 percent rally to further firm up its November range, positioning is showing remarkable consistency. Volume in this congestion is drying up – leveraging the risk of a breakout. Meanwhile, open interest in the futures market has climbed to its highest level in 17 months as ETF holdings has hit a five-year low. This looks like positioning for further losses.

**Bring the economic calendar to your charts with the DailyFX News App.

My god very great post , every one must read and understand , thanks again for this post

its really very good post i like it its so authentic please share more of them...

thanks.

Why don't many people post their daily winning results?

MT4talk PRO members can Turn off MT4talk daily winning result post requirements for $49.99 / month. More info...

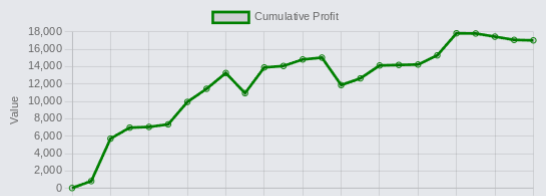

Latest profit posts from the Trade Executor EA users.

By using the MT4talk website, you automatically agree to the Forum Rules & Terms of Use, as well as the terms below.

Everything you see on the MT4talk website is created by its users, mainly the members of the MT4talk forum, as well as the forum administrators.

What is MT4talk?

MT4talk is an online Forex forum with over 5000 Forex robots and over 3000 Forex indicators uploaded by forum members in the last 10 years, available to download from forum posts. The uploaded files do not come with support or any guarantee.

The website does not sell Forex robots and does not provide support for any downloaded Forex robots. MT4talk offers a PRO membership, allowing you to download unlimited files from forum posts. If you choose to download a Forex robot from the forum, you do so at your own risk.

The MT4talk Team also provides an Artificial Intelligence Forex robot called "Trade Executor EA," which can be downloaded by PRO members, just like any other Forex robot on the forum. This Forex robot is only a bonus and is not included in the original PRO membership.

MT4talk is an informational website and does not guarantee the performance, profitability, or reliability of any Forex robot available for download. Updates for Forex robots may be limited or nonexistent, depending on the creator. If you choose to download any Forex robot or setting file from the forum, you acknowledge that you are using it at your own risk. MT4talk PRO membership is a digital product. Therefore, after you complete the PRO membership purchase, there is no refund available!

We are conducting real-life tests on Forex robots to assess their performance. For certain robots, we may use a demo account to conduct tests, and for other Forex robots, we may use a real Forex account. It's essential to recognize that we are not financial advisors and cannot provide investment guidance. Our objective is to discover effective market analysis solutions through testing various strategies, which could be beneficial to our community.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members or the MT4talk EA Tester Team about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

Affiliates Disclaimer - The website may have links to partner websites, and if you sign up and trade through these links, we will receive a commission. Our affiliate partners are FXOpen, FBS, Plexytrade, and MyForexVPS.

Copyright MT4talk.com Forum Rules - Privacy Policy.