Log in or register to download unlimited Forex robots!

Copper cracks under pressure, euro on defensive

* Copper futures dive over 6 pct, oil prices struggling to steady

* ECB seen ever nearer to bond buying, court ruling an unknown

* Bond yields shrink, World Bank cuts global growth forecasts

By Wayne Cole

SYDNEY, Jan 14 (Reuters) - Concerns about the global economy battered commodities and kept Asian equities subdued on Wednesday, while the euro was pinned near nine-year lows as investors bet the European Central Bank was just a week away from launching a new stimulus campaign.

Copper futures suddenly plunged 6.3 percent to $5,489 a tonne as major chart support cracked. The industrial metal is often considered a weathervane of world demand.

Not helping the mood was news that the World Bank had cut its 2015 global growth forecasts to 3 percent from 3.4 percent because of sluggishness in the euro zone, Japan and some major emerging economies.

"The global economy is at a disconcerting juncture," World Bank chief economist Kaushik Basu told reporters. "It is as challenging a moment as it gets for economic forecasting."

That was a challenging background for equities, with MSCI's broadest index of Asia-Pacific shares outside Japan struggling to stay in the black and Australia's main share index slipping 0.3 percent.

Seeking to support growth, Japanese Prime Minister Shinzo Abe's cabinet approved a record $812 billion budget while cutting new borrowing for a third straight year.

The share market seemed underwhelmed, however, and the Nikkei lost 0.8 percent.

Wall Street ended on Tuesday with minor losses, led by a drop in materials and energy shares. It was a choppy session with the S&P 500 swinging from a gain of 1.4 percent to a fall of 1 percent before steadying.

The Dow eased 0.15 percent, while the S&P 500 dipped 0.26 percent and the Nasdaq 0.07 percent.

The dollar outpaced the euro on the back of upbeat U.S. economic data and after two European Central Bank (ECB) officials fuelled expectations that the bank would launch a program at its Jan. 22 policy meeting to buy government bonds.

The common currency fell as far as $1.1753 to reach a low not seen since December 2005. It last traded at $1.1769. Against the yen, the euro slumped to its lowest in over two months near 138.30.

Market attention now turns to the European Court of Justice (ECJ), which is expected to provide a non-binding opinion on the legality of an ECB bond-buying program later on Wednesday.

MONEY FOR NOTHING

The pressure for policy action has grown intense as falling oil prices pulled consumer prices into negative territory across the euro zone last month.

So far this week, Brent has lost 7 percent and U.S. crude 5 percent. On Wednesday, Brent gave up early gains and fell 25 cents to $46.34 per barrel, while U.S. crude shed 20 cents to $45.69.

The impact was clear in the UK where inflation halved to just 0.5 percent in December, the lowest in over 14 years. That only reinforced market expectations the Bank of England would not be able to hike rates until 2016 at the earliest.

Likewise, investors are wagering the Federal Reserve will find it hard to start tightening in the middle of the year, as some policy members have suggested.

In just the past three weeks, Fed fund futures <0#FF:> have priced out 25 basis points of hikes for this year and now see just one move to 0.5 percent by Christmas.

The risk of low inflation for longer has in turn pulled down bond yields globally, with five-year debt in Germany and Japan now paying nothing at all.

One side effect of plunging bond yields is to make gold more attractive as an alternative investment.

Since gold does not pay a return, an opportunity cost for holding it is the yield forgone on safe-haven bonds. Now, that cost has diminished to the point where buying gold offers the same return as lending money to Germany for five years.

The yellow metal was was a shade softer at $1,230.00 an ounce on Wednesday after touching a three-month peak. (Editing by Shri Navaratnam & Kim Coghill)

Why don't many people post their daily winning results?

MT4talk PRO members can Turn off MT4talk daily winning result post requirements for $49.99 / month. More info...

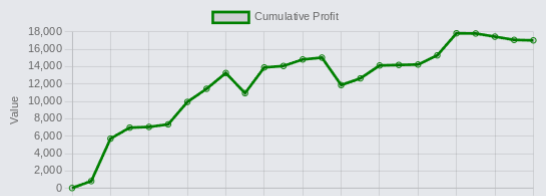

Latest profit posts from the Trade Executor EA users.

By using the MT4talk website, you automatically agree to the Forum Rules & Terms of Use, as well as the terms below.

Everything you see on the MT4talk website is created by its users, mainly the members of the MT4talk forum, as well as the forum administrators.

What is MT4talk?

MT4talk is an online Forex forum with over 5000 Forex robots and over 3000 Forex indicators uploaded by forum members in the last 10 years, available to download from forum posts. The uploaded files do not come with support or any guarantee.

The website does not sell Forex robots and does not provide support for any downloaded Forex robots. MT4talk offers a PRO membership, allowing you to download unlimited files from forum posts. If you choose to download a Forex robot from the forum, you do so at your own risk.

The MT4talk Team also provides an Artificial Intelligence Forex robot called "Trade Executor EA," which can be downloaded by PRO members, just like any other Forex robot on the forum. This Forex robot is only a bonus and is not included in the original PRO membership.

MT4talk is an informational website and does not guarantee the performance, profitability, or reliability of any Forex robot available for download. Updates for Forex robots may be limited or nonexistent, depending on the creator. If you choose to download any Forex robot or setting file from the forum, you acknowledge that you are using it at your own risk. MT4talk PRO membership is a digital product. Therefore, after you complete the PRO membership purchase, there is no refund available!

We are conducting real-life tests on Forex robots to assess their performance. For certain robots, we may use a demo account to conduct tests, and for other Forex robots, we may use a real Forex account. It's essential to recognize that we are not financial advisors and cannot provide investment guidance. Our objective is to discover effective market analysis solutions through testing various strategies, which could be beneficial to our community.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members or the MT4talk EA Tester Team about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

Affiliates Disclaimer - The website may have links to partner websites, and if you sign up and trade through these links, we will receive a commission. Our affiliate partners are FXOpen, FBS, Plexytrade, and MyForexVPS.

Copyright MT4talk.com Forum Rules - Privacy Policy.