Log in or register to download unlimited Forex robots!

The Fed's Interest Rates and Crypto: A Crucial Connection

The relationship between the Federal Reserve's interest rate decisions and the cryptocurrency market is a topic of increasing importance for investors and analysts alike. As the central bank of the United States, the Federal Reserve (the Fed) plays a pivotal role in shaping the country's monetary policy, including setting interest rates. These decisions directly influence the broader financial markets, and as it turns out, have a significant impact on the volatile world of cryptocurrencies as well.

Interest Rates and Their Economic Impact

The Fed adjusts interest rates to manage economic growth and control inflation. Lowering interest rates makes borrowing cheaper, encouraging spending and investment, which can stimulate the economy. Conversely, raising rates makes borrowing more expensive, aiming to cool down an overheating economy and curb inflation.

Cryptocurrency's Reaction to Interest Rate Changes

Cryptocurrencies, despite their decentralized nature, are not immune to the effects of these monetary policy changes. Generally, asset prices, including stocks, bonds, and cryptocurrencies, tend to move inversely to interest rates. When rates are low, the yield on safer investments like bonds decreases, making high-risk, high-reward assets such as cryptocurrencies more attractive to investors seeking better returns. This demand can drive up crypto prices.

On the other hand, when the Fed increases interest rates, the appeal of cryptocurrencies diminishes. Higher rates enhance the attractiveness of safer assets, leading to a shift away from riskier investments. This change can result in decreased demand for cryptocurrencies, contributing to price drops.

Historical Trends and Evidence

The impact of interest rate changes on cryptocurrencies can be observed through historical market movements. For instance, during periods of rate hikes under Fed Chair Janet Yellen in 2018, Bitcoin experienced a significant decline, dropping from its peak of nearly $20,000 to around $3,200 by the end of the year. Conversely, the period of ultra-low interest rates during the COVID-19 pandemic saw Bitcoin reaching record highs, demonstrating the sensitivity of crypto markets to Fed policy changes.

The Role of Investor Behavior

Investor behavior also plays a crucial role in how cryptocurrencies respond to interest rate adjustments. In a low-rate environment, the search for higher yields drives investors towards cryptocurrencies, increasing their prices. However, as rates rise, the increased attractiveness of safe-haven assets and the higher cost of borrowing discourage investment in cryptocurrencies, leading to price declines.

Looking Ahead

The intricate relationship between Federal Reserve interest rate decisions and cryptocurrency markets underscores the interconnectedness of traditional financial systems and digital currencies. While the short-term impacts of rate changes on cryptocurrencies can be pronounced, the long-term effects remain a subject of debate among investors and analysts.

As the Fed continues to navigate economic challenges, its interest rate decisions will undoubtedly remain a critical factor for the crypto market. For investors, keeping a close watch on the Fed's monetary policy moves is essential for making informed decisions in the rapidly evolving cryptocurrency landscape.

In summary, the Federal Reserve's interest rate decisions play a significant role in shaping the cryptocurrency market's dynamics. By influencing investor behavior and market demand, these monetary policy adjustments can lead to notable fluctuations in crypto prices. As the digital currency market continues to mature, understanding the impact of these traditional financial mechanisms will be crucial for anyone involved in the crypto space.

Source: cointelegraph.com

Why don't many people post their daily winning results?

MT4talk PRO members can Turn off MT4talk daily winning result post requirements for $49.99 / month. More info...

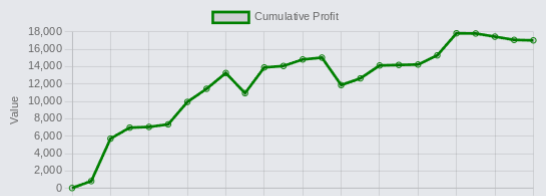

Latest profit posts from the Trade Executor EA users.

By using the MT4talk website, you automatically agree to the Forum Rules & Terms of Use, as well as the terms below.

Everything you see on the MT4talk website is created by its users, mainly the members of the MT4talk forum, as well as the forum administrators.

What is MT4talk?

MT4talk is an online Forex forum with over 5000 Forex robots and over 3000 Forex indicators uploaded by forum members in the last 10 years, available to download from forum posts. The uploaded files do not come with support or any guarantee.

The website does not sell Forex robots and does not provide support for any downloaded Forex robots. MT4talk offers a PRO membership, allowing you to download unlimited files from forum posts. If you choose to download a Forex robot from the forum, you do so at your own risk.

The MT4talk Team also provides an Artificial Intelligence Forex robot called "Trade Executor EA," which can be downloaded by PRO members, just like any other Forex robot on the forum. This Forex robot is only a bonus and is not included in the original PRO membership.

MT4talk is an informational website and does not guarantee the performance, profitability, or reliability of any Forex robot available for download. Updates for Forex robots may be limited or nonexistent, depending on the creator. If you choose to download any Forex robot or setting file from the forum, you acknowledge that you are using it at your own risk. MT4talk PRO membership is a digital product. Therefore, after you complete the PRO membership purchase, there is no refund available!

We are conducting real-life tests on Forex robots to assess their performance. For certain robots, we may use a demo account to conduct tests, and for other Forex robots, we may use a real Forex account. It's essential to recognize that we are not financial advisors and cannot provide investment guidance. Our objective is to discover effective market analysis solutions through testing various strategies, which could be beneficial to our community.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members or the MT4talk EA Tester Team about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

Affiliates Disclaimer - The website may have links to partner websites, and if you sign up and trade through these links, we will receive a commission. Our affiliate partners are FXOpen, FBS, Plexytrade, and MyForexVPS.

Copyright MT4talk.com Forum Rules - Privacy Policy.